Senior Citizen Savings Scheme (SCSS) is a government-backed investment plan designed for people aged 60 and above. Introduced in 2004, it provides a reliable and steady income for retirees, helping them stay financially secure during retirement. The scheme is available through post offices and select banks across India.

Key Features of the Senior Citizen Savings Scheme

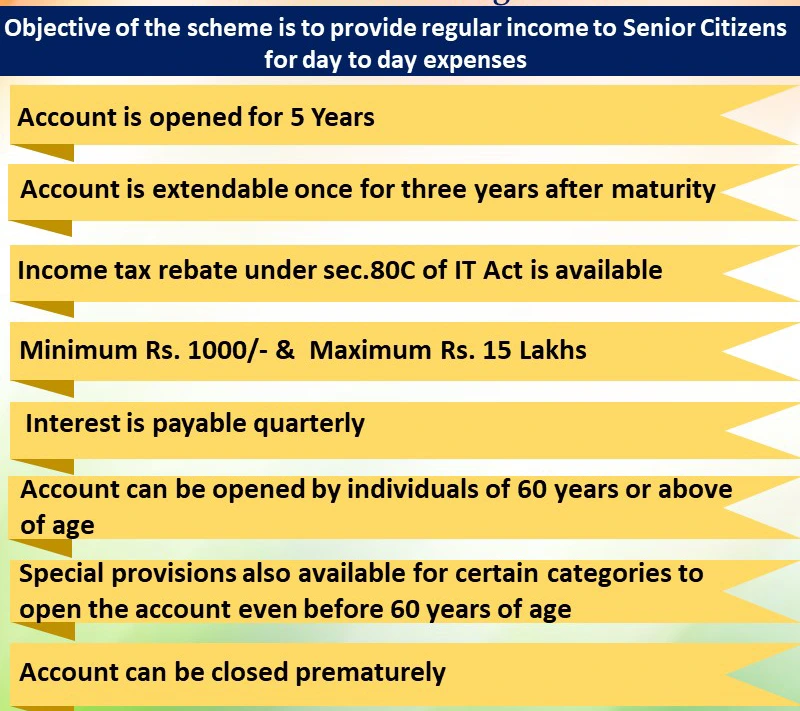

Here are the main features that make SCSS an appealing option for senior citizens:

Fixed Interest Rate

The SCSS offers a fixed interest rate of 8.2% per annum. This rate remains constant throughout the investment period, ensuring you get a steady return without worrying about market changes.

Single Lump-Sum Deposit

You can invest a lump sum amount in multiples of Rs 1,000, with a maximum of Rs 30 lakh. This makes it easy to set up your retirement savings in one go.

Maturity Period

The SCSS has a five-year maturity period. You can extend the scheme for another three years by applying within one year of the initial maturity, allowing you to continue earning interest.

Multiple Accounts

You can open multiple SCSS accounts and even a joint account with your spouse, tailoring your investments to your financial needs.

Premature Withdrawals

You can make premature withdrawals after one year, but there’s a penalty for doing so. This option gives you some flexibility in case of unexpected needs.

Tax Benefits

The SCSS provides tax deductions up to Rs 1.5 lakh under Section 80C of the Income Tax Act. However, the interest earned is taxable according to your income tax slab.

Eligibility Criteria

To invest in the SCSS, you need to meet these criteria:

- Age: Must be 60 years or older.

- Retirement: Individuals between 55 and 60 who have retired under Voluntary Retirement Scheme (VRS), Special VRS, or superannuation are also eligible.

- Citizenship: Must be an Indian citizen.

- Defence Personnel: Retired defence personnel are eligible as well.

How to Apply for the SCSS

Applying for an SCSS account is straightforward:

- Visit a Bank or Post Office: Go to a branch that offers the SCSS.

- Obtain and Complete the Application Form: Request the form, fill it out with your details, and include nominee information.

- Submit the Form: Submit the completed form along with necessary documents and your deposit amount.

Tax Benefits of the SCSS

The SCSS offers useful tax benefits:

- Deduction under Section 80C: Investments up to Rs 1.5 lakh qualify for tax deductions, reducing your taxable income.

- Interest Income: The interest earned is taxable based on your income tax slab.

Maturity and Extension Options

The SCSS matures in five years, but you can extend it for an additional three years by applying within one year of maturity.

Withdrawal Options and Rules

Here are the withdrawal options:

- Premature Withdrawal: Allowed after one year with a 1% penalty.

- Partial Withdrawal: Allowed after three years, up to 25% of the deposit amount, with a limit of three withdrawals.

- Full Withdrawal: Available at maturity or upon extension.

Pros and Cons of the Senior Citizen Savings Scheme

Pros:

- Guaranteed Returns: Provides a stable income with a fixed interest rate.

- Tax Benefits: Offers tax deductions under Section 80C.

- Government Backed: High security due to government backing.

- Long-Term Investment: Encourages savings over a longer period.

Cons:

- Limited Liquidity: Restrictions on early withdrawals might not suit those needing immediate access.

- Limited Withdrawal Options: Withdrawals are restricted to certain conditions.

- Fixed Interest Rate: May be less competitive compared to market-linked investments during high inflation.

Try This: NPS Vatsalya Calculator

Senior Citizen Savings Scheme vs. Fixed Deposits

Here’s a quick comparison between SCSS and Fixed Deposits (FDs):

| Feature | SCSS | Fixed Deposit |

|---|---|---|

| Interest Rate | Fixed at 8.2% | Varies with bank and tenure |

| Tax Benefits | Tax deductions under Section 80C | No tax deductions |

| Maturity Period | 5 years, extendable by 3 years | Varies with bank and tenure |

| Minimum Deposit | Rs 1,000 | Varies with bank |

| Maximum Deposit | Rs 30 lakh | Varies with bank |

| Liquidity | Limited | Generally more liquid |

Is the Senior Citizen Savings Scheme Right for You?

The SCSS could be a good fit if you:

- Prioritize Security: Want a government-backed scheme with guaranteed returns.

- Have a Long-Term Horizon: Plan to save for 5-8 years.

- Value Tax Benefits: Want to lower your tax liability.

However, it may not be ideal if you:

- Need Short-Term Access: Limited liquidity might be a problem.

- Seek Higher Returns: Consider other investments for potentially higher returns.

- Need Frequent Withdrawals: Look for options that offer easier access to funds.

Frequently Asked Questions FAQ’s

- What is the minimum investment amount? Rs 1,000.

- Can I open an SCSS account online? No, you need to visit a bank or post office.

- What is the maximum amount I can invest? Rs 30 lakh.

- Can I withdraw the full amount before maturity? Full withdrawal is possible at maturity or upon extension. Premature withdrawals have a penalty.

- How is the interest rate set? Fixed by the government and reviewed periodically.

- What happens if the account holder passes away? The account can be continued by the nominee or legal heir.

Final Thoughts

The Senior Citizen Savings Scheme (SCSS) is a valuable option for retirees in India who are looking for a secure and steady income source. With its fixed interest rate, tax benefits, and government backing, it offers a reliable way to plan for retirement. However, the limited withdrawal options and fixed returns mean it may not suit everyone. Carefully consider your financial needs and investment goals before deciding if SCSS is the right choice for you.