NPS Vatsalya

How to Register For The NPS Vatsalya Scheme Online

January 19, 2025

NPS Vatsalya Withdrawal Rules: Flexibility When It Matters

September 22, 2024

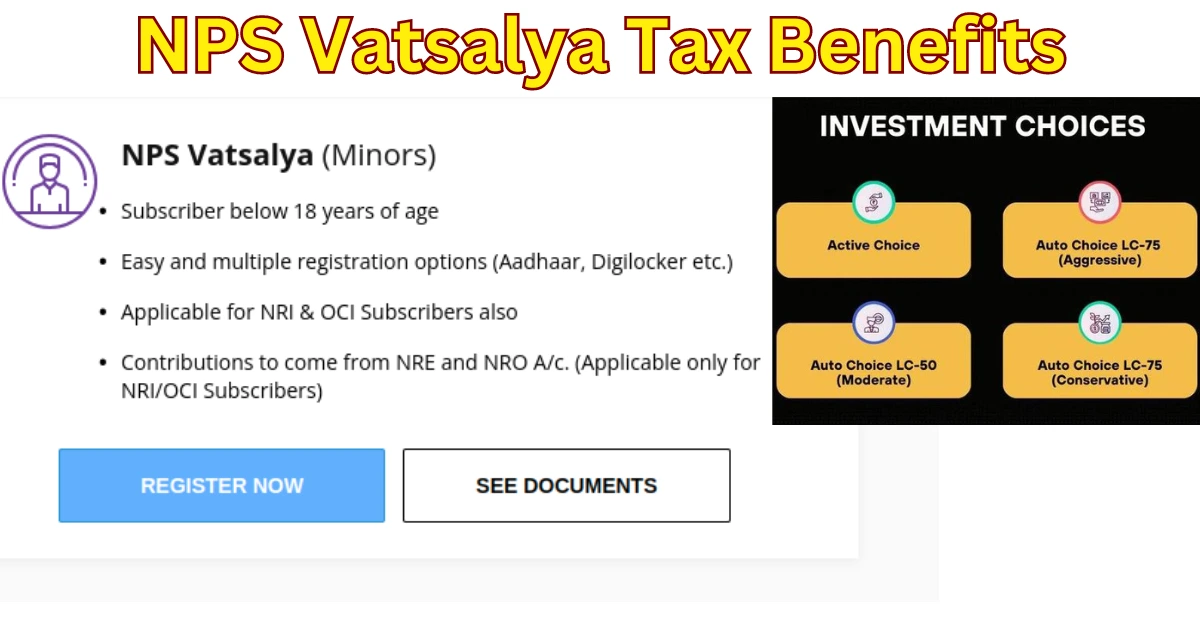

NPS Vatsalya Tax Benefits: Securing Your Child’s Future with Tax Savings

September 21, 2024

Personal Finance

Investment Outlook 2026: Where Indian Investors Stand

January 11, 2026

US Supreme Court Tariff Decision: What It Means for Indian Markets

January 10, 2026

Invest Smart After GST 2.0: Strategies for Indian Investors

September 14, 2025

Why India’s Consumption Story is an Investment You Can’t Ignore

September 13, 2025

GST Reforms: A Financial Game-Changer for India

September 6, 2025