Income Tax Refund: Understanding Section 154(1) and Rectification Requests

Filing your income tax return (ITR) is a significant financial task, and awaiting the refund can be both exciting and nerve-wracking. When the refund amount is lower than expected, it’s natural to feel a bit disheartened. But don’t fret! The Indian Income Tax Department offers a solution through Section 154(1), allowing taxpayers to request a rectification for discrepancies in their ITR, including lower-than-expected refunds.

Why is My Income Tax Refund Lower Than Expected?

Before diving into the rectification process, let’s shed light on the common culprits behind lower income tax refunds:

- Tax Credit Mismatch: Discrepancies between claimed and actual tax credits often lead to refund adjustments.

- Incorrect Personal Details: Errors in PAN, address, or other personal information can cause processing hiccups.

- Errors in ITR Filing: Incorrect income declarations, deduction claims, or other filing errors can impact the refund amount.

Understanding Income Tax Intimation Under Section 143(1)

After filing your ITR, the Income Tax Department processes it. If everything is in order, you’ll receive an intimation under Section 143(1) on your registered email address. This intimation serves as confirmation of the ITR processing and includes details about your tax liability or refund due.

What does an intimation under Section 143(1) contain?

- Computation of your total income

- Taxes due or refund payable

- Details of tax deducted at source (TDS)

- Advance tax paid

- Self-assessment tax paid

What if the income tax refund amount mentioned in the intimation is incorrect?

If you find discrepancies in the calculated refund amount or other details in the intimation, don’t ignore it. You have the right to file a rectification request under Section 154 of the Income Tax Act, 1961.

Section 154 Rectification: Your Right to Correct ITR Errors

Section 154 empowers taxpayers to seek rectification for specific errors in their processed ITR. But remember, this is not a route to make changes to your original return (for that, you’d file a revised return). Rectification is meant to address mistakes apparent from the tax department’s records.

Types of Rectification Requests You Can File:

- Reprocess the Return: This option is suitable when the Income Tax Department needs to reprocess your entire return due to errors in their system or data processing.

- Tax Credit Mismatch Correction: If you find discrepancies in the tax credits considered in your intimation, opt for this request type.

- Return Data Correction (Offline): For correcting errors in personal information or other offline data, choose this option.

Read More: How to Get a Monthly Pension of Rs 1 Lakh NPS

How to File a Rectification Request Online:

Thankfully, the process of filing a rectification request is now digitized, making it convenient for taxpayers. Follow these steps:

- Log in to the Income Tax e-filing Website: Visit the official website (https://www.incometax.gov.in/iec/foportal/) and log in using your user ID (PAN), password, and captcha code.

- Navigate to ‘My Account’: Once logged in, locate and click on the ‘My Account’ tab on the dashboard.

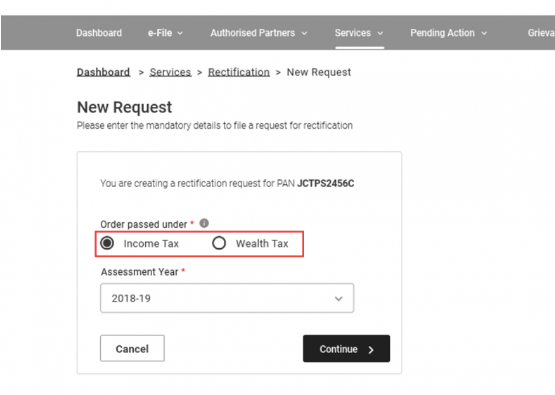

- Select ‘Rectification Request’: From the dropdown menu, choose ‘Rectification Request’ and then click on ‘New Request.’

- Provide Relevant Details: Fill in the required information, including the assessment year and type of rectification request.

- Submit and Track: Carefully review the details, submit the rectification request, and keep track of its status online.

What if Your Rectification Request is Rejected?

While the Income Tax Department aims to process rectification requests smoothly, rejections can occur. If your request is rejected, don’t panic. Take these steps:

- Understand the Reasons: Review the rejection notice carefully to understand the specific reasons for rejection.

- Refile with Corrections: Address the issues highlighted in the rejection notice and file a revised rectification request.

Essential Tips and Precautions for a Smooth Rectification Process:

- Accuracy is Key: Double-check all information and documentation before submitting your rectification request.

- Timely Action is Crucial: File your rectification request within the stipulated time limit to avoid delays or penalties.

- Seek Professional Help: If you’re unsure about the process or need assistance, consult a qualified chartered accountant (CA) for guidance.

Read More: New Pension Scheme ‘NPS Vatsalya’ Launched for Minors: A Future Investment Opportunity

FAQs on ITR Refund Rectification

Let’s address some frequently asked questions about the rectification process:

What is the time limit for filing a rectification request under Section 154?

You can file a rectification request up to four years from the end of the financial year in which the intimation under Section 143(1) was issued. For example, if your intimation for FY 2022-23 was issued on June 15, 2023, you can file a rectification request until March 31, 2027.

Can I file a rectification request for mistakes made in the original return?

No, rectification requests are not for correcting errors made while filing the original return. For that, you’d need to file a revised return. Rectification requests are specifically for mistakes apparent from the records of the Income Tax Department.

Do I need to physically visit the Income Tax office to file a rectification request?

No, the entire process of filing a rectification request is online. You can easily do it yourself through the Income Tax Department’s e-filing website.

What documents are required to be submitted along with the rectification request?

Generally, you don’t need to attach any documents while filing the rectification request online. However, it’s best to keep supporting documents (like Form 16, TDS certificates, investment proofs) handy in case the tax department requests them later.

What happens after I submit the rectification request?

The Income Tax Department will process your rectification request. If approved, they’ll issue a rectified order with the correct details and refund amount. If rejected, you’ll receive a notice explaining the reasons.

What should I do if my refund is not credited even after the rectification is processed?

In such cases, you can contact the Centralized Processing Centre (CPC) of the Income Tax Department through their helpline numbers or email. You can also reach out to your Assessing Officer for assistance.

Try This: NPS Vatsalya Calculator

Section 154(1) for rectification

Don’t let the spirits go down when you receive a lower-than-expected income tax refund. Be aware of your rights as a taxpayer and take full advantage of those provisions designed to help, like Section 154(1) for rectification. Only you can get the right income tax refund that you should have by being proactive and informed.