Understanding Financial Independence

Best Investment Options for Financial Independence are crucial for achieving a state where you have sufficient wealth to cover your living expenses without relying on a salary or wages. Achieving financial independence requires discipline, patience, and a well-planned investment strategy.

Why Invest for Financial Independence?

Investing for financial independence offers numerous benefits, including:

- Wealth creation: Investing helps grow your wealth over time, providing a safety net for the future.

- Passive income: Investments can generate passive income, reducing reliance on a salary.

- Freedom: Financial independence offers the freedom to pursue your passions and interests.

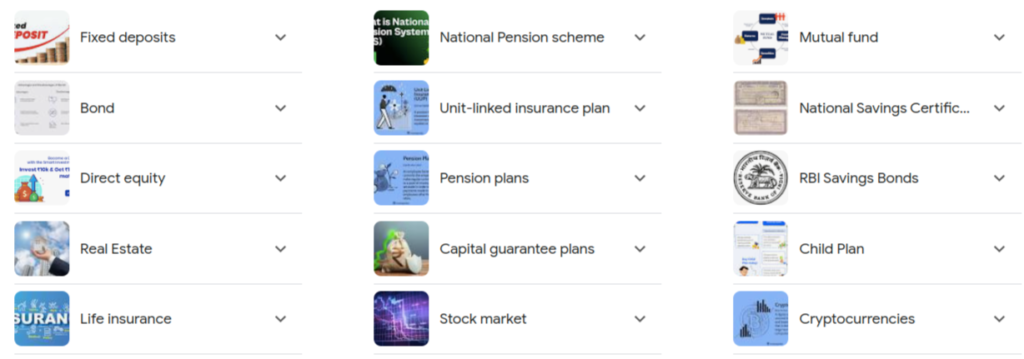

Best Investment Options for 2024

Direct Equity: High Returns with Higher Risks

Direct equity investment involves buying stocks directly, offering high returns but also higher risks. It’s essential to research and diversify your portfolio to minimize risk.

Mutual Funds: Diversified Portfolios for Medium to High Risk

Mutual funds offer a diversified portfolio and professional management, making them a popular choice. They provide various schemes, including equity, debt, and hybrid funds.

Public Provident Fund (PPF): Low-Risk Savings Scheme

PPF is a long-term savings scheme with a fixed interest rate, currently 7.1% per annum. It offers tax benefits and is suitable for risk-averse investors.

Real Estate Investment Trusts (REITs): Regular Income and Capital Appreciation

REITs allow individuals to invest in real estate without directly owning physical properties. They offer regular income and potential long-term capital appreciation.

National Pension System (NPS): Retirement-Focused Investment Scheme

NPS is a retirement-focused investment scheme offering tax benefits and a range of investment options. It’s suitable for those planning for retirement.

Assessing Risk Tolerance

Understanding Personal Risk Tolerance

Assessing your risk tolerance is crucial to creating an effective investment strategy. Risk tolerance refers to your ability to withstand market fluctuations and potential losses.

Risk Assessment Tools and Techniques

Several tools and techniques can help assess your risk tolerance, including:

- Risk questionnaires: Standardized questionnaires that evaluate your risk tolerance based on your answers.

- Risk profiling tools: Online tools that assess your risk tolerance and provide personalized investment recommendations.

Read More: How to Get a Monthly Pension of Rs 1 Lakh NPS

Setting Clear Financial Goals

Short-Term and Long-Term Financial Goals

Setting clear financial goals helps you focus your investment strategy. Short-term goals include:

- Emergency fund

- Saving for a down payment on a house

Long-term goals include:

- Retirement planning

- Wealth creation

Creating a Financial Roadmap

A financial roadmap outlines your financial goals, risk tolerance, and investment strategy. It serves as a guide for your investment decisions.

Diversifying Investments

Importance of Diversification

Diversification is key to unlocking optimal portfolio performance. By allocating your investments across diverse asset classes, sectors, and geographies, you can balance risk and potential returns, securing your path to long-term financial success.

Asset Allocation Strategies

Asset allocation strategies include:

- Conservative: Low-risk investments, such as bonds and money market funds.

- Moderate: Balanced investments, including stocks, bonds, and mutual funds.

- Aggressive: High-risk investments, such as stocks and real estate.

Try This: NPS Vatsalya Calculator

Starting Early and Compounding

Power of Compounding

Compounding is the process of earning interest on your interest, leading to exponential growth over time. Starting early allows you to harness the power of compounding.

Early Investment Strategies

Early investment strategies include:

- Regular investing: Investing a fixed amount regularly, regardless of market conditions.

- Dollar-cost averaging: Investing a fixed amount at regular intervals, reducing the impact of market volatility.

Regular Portfolio Review and Adjustment

Monitoring Investment Performance

Regularly reviewing your portfolio helps you:

- Track performance: Monitor your investments’ performance and adjust accordingly.

- Rebalance: Rebalance your portfolio to maintain your target asset allocation.

Rebalancing and Adjusting Portfolios

Rebalancing involves:

- Buying low-performing assets: Buying assets that have underperformed.

- Selling high-performing assets: Selling assets that have exceeded their target allocation.

Try This: SSY CALCULATOR

Frequently Asked Questions (FAQ’s):Best Investment Options for Financial Independence

What is the best investment option for 2024?

The Best Investment Options for Financial Independence for 2024 depends on your risk tolerance, financial goals, and time horizon. It’s essential to consult with a financial advisor.

How do I assess my risk tolerance?

Risk tolerance can be assessed using risk questionnaires, risk profiling tools, and consulting with a financial advisor.

What are the benefits of diversifying investments?

Diversification minimizes risk, maximizes returns, and provides a hedge against market volatility.

How often should I review and adjust my portfolio?

Portfolios should be reviewed regularly, ideally every 6-12 months, and adjusted as needed.

What is the importance of starting early and compounding?

Starting early allows you to harness the power of compounding, leading to exponential growth over time.

How do I create a financial roadmap?

A financial roadmap can be created by setting clear financial goals, assessing risk tolerance, and developing an investment strategy using Best Investment Options for Financial Independence.