Income Tax Calculator

As per the latest budget announced on July 23, 2024

Income Details

Deductions (Only for Old Regime)

Tax Calculation Results

| Post-Budget (Old Regime) | Post-Budget (New Regime) | |

|---|---|---|

| Total Income | ||

| Exempt Allowances | ||

| Standard Deductions | ||

| Chapter VI A Deductions | ||

| Taxable Income | ||

| Tax Due |

How the Income Tax Calculator New Regime Works

Income Tax Calculator New Regime: Slated to be user-friendly, the Income Tax Calculator New Regime certainly does live up to its promise. Being an online tool, it simplifies what may otherwise turn into a time-consuming task of tax calculation—it can help you reach an estimate of your tax liability in just a few clicks. Here’s how to use this calculator, step by step:

- Choose Financial Year: In the beginning, choose the Financial Year for which you wish to estimate income tax. For the current year, select FY 2024-25 (AY 2025-26).

- Age: Indicate your age as of April 1 of the chosen Financial Year. This is important because the slabs and rates of income tax in India would be different for various age groups.

- Filing Your Income Details: Accurately furnish all information regarding the income you have earned from different sources of income, such as:

- Income from Salary: Mention your gross salary

- Interest Income: Interest from savings accounts, fixed deposits, and other sources.

- Rental Income: If you have property that gives you rental income, declare the total rent received during the financial year.

- Income from Digital Assets: In the hot digital economy, digital assets, including cryptocurrency, are becoming increasingly important. Declare any profits from the sale of such assets.

- Other Income: Any other income not otherwise dealt with above.

- Deductions to Consider (Old Regime): Though the new regime has reduced tax rates with an overall more simplified structure, it has definitely cut down many deductions and exemptions available in the old regime. Some of them, however, such as employer contributions towards the NPS under Section 80CCD(2), may still apply.

- Calculating Your Tax Liability: Once all the required information is given, it processes the data and gives an estimated income tax liability for the assessment year in question.

- Comparative Analysis: Of all the noted features, this calculator offers the ability to facilitate a side-by-side comparison of your tax liability under both the old and new regimes. Be in a better position to decide which regime will work more in your interest, keeping in mind your financial situation.

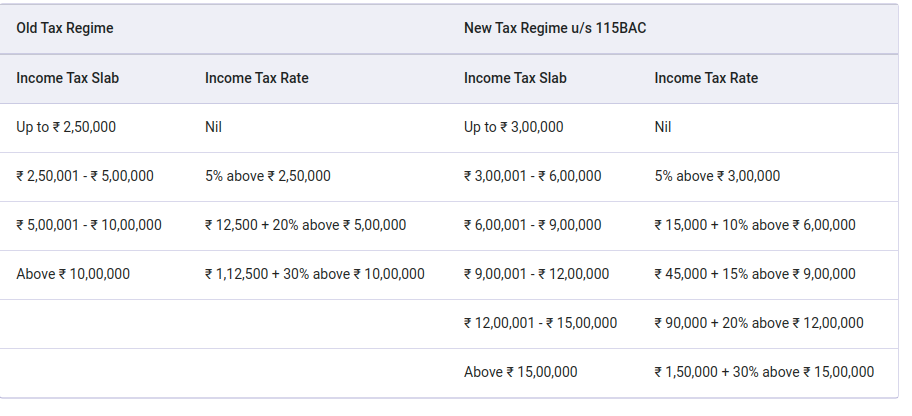

Income Tax Slabs Under New Tax Regime for FY 2024-25

Decoding the Indian Income Tax Landscape

The Indian financial scenario is always dynamic, and with the changing times, every year brings some or other amendments to the Income Tax. The Union Budget, therefore, presented annually, acts as the forerunner of this change and hence has a substantial impact on the financial planning for every taxpayer. Of the several tools at one’s command in navigating this labyrinthine maze of legislation, the Income Tax Calculator New Regime is the torch bearer that can bring a semblance of light to the confused mind of the taxpayer. A masterful update executed to integrate the amendments brought out in Union Budget 2024-25 empowers the individual to estimate tax liabilities proactively and strategize their finances for the best outcome.

Income Tax Calculator New Regime: Your Guide to FY 2024-25

We will go into the details of the Income Tax Calculator New Regime for FY 2024-25. It would arm you with knowledge and aids necessary to move effectively in the Indian tax landscape. We will break down the nuances of the new regime, its implications for different groups of people, and empower you with the ability to make informed financial decisions.

Need to Calculate Income Tax Explained

Before getting into working details of the calculator, it’s very essential to understand the basic idea behind income tax calculation in India. But, why is this annual ritual so important for every earning person and HUF? Let us enlighten the importance of it:

- Cornerstone of Financial Planning: Income tax forms a bulk of the expenditure of an individual or HUF in a year. Calculating the tax liability properly is of prime importance for budgeting and financial planning.

- Legal Compliance: In India, filing returns of income tax and paying related taxes before the deadlines is a legal duty for every eligible taxpayer. Non-compliance may attract penalties and legal problems.

- See-Through Financial System: An effective system of income tax makes the financial dealings of individuals and HUFs open and faultless, hence a more healthful economy.

- Nation Building: Income tax forms a significant part of the government’s income. The funds thus raised are utilized to give the public essential services like health, education, infrastructure, and national defense, thus helping to build a growing and prosperous nation.

Navigating the Income Tax Maze: Key Considerations for FY 2024-25

The new tax regime brought in by Budget 2020 has indeed been a turning point for income tax in India. This has left the choice with every taxpayer: either to remain in the regime with a cascading array of deductions and exemptions or opt for the new regime that reduces rates but with limited deductions.

Why Knowing the Nuances: Old Regime vs New Regime is Important:

Any informed decision vis-à-vis the regime to choose has to be based on an understanding of the differences between the old and the new regimes. Let us break them down for a comprehensive comparison:

| Feature | Old Regime | New Regime |

|---|---|---|

| Tax Rates | Progressive tax rates ranging from 5% to 30% | Lower tax rates starting from 5% and going up to 30% |

| Standard Deduction | ₹50,000 for salaried individuals and pensioners | ₹75,000 for salaried individuals and pensioners |

| Deductions & Exemptions | An array of deductions and exemptions in many of the sections in the Income Tax Act | Limited deductions and most popular exemptions withdrawn |

Which One to Opt for and What to Keep in Mind While Choosing Between the Regimes:

The decision of choosing between the old and the new tax regime is not a one-size-fits-all. There are several factors to consider, and the best choice varies depending on an individual’s financial position. Here are some factors to consider:

- Level of Income: Generally, for individuals with lower incomes, the rates under the new regime are attractive.

- Investment Strategy: If you have been investing regularly in tax-saving products like PPF, NPS, or life insurance policies, then the old regime may be more beneficial.

- Home Loan Interest: Interest on home loans is allowed as a big deduction under the old regime. If you are a homeowner and servicing a home loan, the old regime may be advantageous.

Beyond the Calculator: Other Tips to Help You in Tax Planning

While this New Regime Income Tax Calculator offers an important view on estimating your tax liability, it remains a part of the puzzle. Below are some options for further optimization of tax outgo toward financial goals:

- Early Bird Catches the Worm: Begin planning for your taxes right at the start of the financial year, not towards the end. This will enable you to invest in tax-saving instruments strategically and optimize your deductions to the fullest.

- Seek Expert Advice: If your financial situation is complex, consult a qualified chartered accountant or tax consultant for personalized guidance.

The information contained in this guide is intended for informational purposes only and does not constitute financial or legal advice. A qualified professional should be consulted for personalised advice concerning your situation.

Try This: NPS Vatsalya Calculator

Frequently Asked Questions (FAQs) on Income Tax Calculator New Regime

Is the Income Tax Calculator New Regime applicable for every taxpayer in India?

Yes, the new regime is applicable for all resident Indians and HUFs falling within the income tax legislation. It helps compute the tax liability under the new regime for individuals earning through salary, business, freelance, or other sources.

Can I switch between the old and new tax regimes every year?

Yes, the choice between the old and new tax regimes is not irrevocable. You can opt for the regime that best suits your tax planning strategy each year.

What is the difference between AY and FY?

FY (Financial Year) is the period from April 1 to March 31, representing the year in which you earn income. AY (Assessment Year) is the year following the Financial Year, during which your income from the FY is assessed and taxed.

Is there a need to use the Income Tax Calculator New Regime?

Income Tax Calculator New Regime is optional and is designed to help estimate your tax liability. The actual tax liability will be determined by your income and deductions as per provisions.

What if the actual tax liability differs from the estimate given by the calculator?

The calculator provides an approximate value based on the information provided. Actual tax liability may vary due to various factors. Consult a tax professional if discrepancies arise.

Try This: SSY CALCULATOR

Informed Financial Decisions

In a nutshell, remaining vigilant, aware, and planning ahead is imperative for navigating the Indian Income Tax regime. The Income Tax Calculator New Regime acts as a crucial tool for understanding tax liabilities and making informed financial decisions. By understanding the new regime’s nuances and using the calculator, you can effectively manage your tax outgo and pave the way for a secure financial future. Remember, knowledge is the first step towards financial empowerment.

Home Loan EMI Calculator

Calculate your monthly home loan EMI and plan your finances effectively.

EMI Calculator for Car Loan

Determine your car loan EMI to manage your budget with ease.

Gratuity Calculator

Estimate your gratuity amount based on your service period and salary.

In Hand Salary Calculator India

Calculate your take-home salary after deductions to better understand your earnings.

NPS Vatsalya Calculator

Estimate Your Child’s Future Retirement Savings Using NPS Vatsalya Calculator