Investing is the cornerstone of a secure financial future. With so many options available in the Indian market, selecting the right investment avenue can be daunting. This article breaks down how NPS Vatsalya compares with other popular investment options like Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), diversified equity funds, and aggressive hybrid funds. Let’s explore their key features, benefits, and suitability for different financial goals.

Try This: NPS Vatsalya Calculator

| Criteria | NPS Vatsalya | PPF | SSY | Diversified Equity Funds | Aggressive Hybrid Funds |

|---|---|---|---|---|---|

| Tenure | Until age 60 | 15 years (extendable) | Until 21 years or marriage | No lock-in period | No lock-in period |

| Partial Withdrawals | 25% after 3 years | From 7th year onward | 50% after age 18 | Anytime | Anytime |

| Expected Returns | ~12% p.a. | ~7.1% p.a. | ~8.2% p.a. | ~14% p.a. | ~13.5% p.a. |

| Taxability of Returns | Withdrawals tax-free; annuity taxable | Tax-free (EEE category) | Tax-free (EEE category) | 10% (long-term gains) | 10% (long-term gains) |

| Minimum Investment | ₹1,000 annually | ₹500 annually | ₹250 annually | ₹500 per month (SIP) | ₹500 per month (SIP) |

| Maximum Investment | No limit | ₹1.5 lakh annually | ₹1.5 lakh annually | No limit | No limit |

| Who Should Invest? | Retirement planners | Risk-averse, tax-savers | Parents of girl children | High-risk takers | Moderate-risk takers |

Understanding Tenure

- NPS Vatsalya: This scheme has a long-term tenure, extending until the investor reaches 60 years of age. It’s designed specifically for retirement planning.

- PPF: With a 15-year tenure and the option to extend in 5-year blocks, PPF is suitable for medium-term financial goals.

- SSY: This scheme matures when the girl child turns 21 or marries, making it a tailored option for child-related goals.

- Diversified Equity Funds & Aggressive Hybrid Funds: Both offer high liquidity with no lock-in period, ideal for short-term or flexible investments.

Key Insight:

If your goal is retirement, NPS Vatsalya offers a structured and disciplined approach.

Flexibility in Withdrawals

- NPS Vatsalya: Partial withdrawals of up to 25% are permitted after three years under specific conditions, providing some liquidity.

- PPF: Withdrawals are allowed from the 7th year, up to 50% of the balance.

- SSY: Withdrawals up to 50% are allowed once the girl turns 18, ensuring funds for education or marriage.

- Diversified Equity & Aggressive Hybrid Funds: Complete flexibility for withdrawals at any time.

Key Insight:

For frequent or early access to funds, equity and hybrid funds provide unmatched liquidity.

Read More: NPS Vatsalya Tax Benefits: Securing Your Child’s Future with Tax Savings

Expected Returns

- NPS Vatsalya: Offers a potential return of ~12% annually, leveraging a 75% equity and 25% debt allocation.

- PPF: Provides stable returns around 7.1% annually (revised quarterly).

- SSY: Currently offers an 8.2% annual return, among the highest in debt instruments.

- Diversified Equity Funds: Market-linked returns average 14% annually, with higher risk.

- Aggressive Hybrid Funds: Average returns are around 13.5% annually, balancing equity growth with debt stability.

Key Insight:

For higher long-term returns, equity-based funds outshine, but NPS Vatsalya balances growth and stability well for retirement needs.

Tax Efficiency

NPS Vatsalya: Partial withdrawals are tax-free, but the annuity purchased at maturity is taxable.

- PPF & SSY: Both fall under the EEE (Exempt-Exempt-Exempt) category, offering complete tax-free returns.

- Diversified Equity Funds: Gains above ₹1.25 lakh attract 10% tax if held for over a year.

- Aggressive Hybrid Funds: Taxed similarly to equity funds.

Key Insight:

For maximum tax savings, PPF and SSY are the most efficient. NPS Vatsalya provides significant benefits for retirement-focused investors.

Read More: NPS Vatsalya: Ensuring Retirement Security for India’s Future Generations

Investment Allocation

- NPS Vatsalya: Offers up to 75% equity exposure, balancing risk and reward.

- PPF & SSY: 100% debt-based, providing safe and stable returns.

- Diversified Equity Funds: Fully equity-focused, catering to high-risk appetites.

- Aggressive Hybrid Funds: Allocate 65–80% to equities and the rest to debt, reducing volatility.

Key Insight:

For balanced growth, NPS Vatsalya and hybrid funds are excellent choices.

Minimum and Maximum Investment

NPS Vatsalya: Minimum annual contribution is ₹1,000 with no upper limit, making it accessible and flexible.

- PPF: Requires a minimum of ₹500 annually, capped at ₹1.5 lakh per year.

- SSY: Contributions range from ₹250 to ₹1.5 lakh annually.

- Diversified Equity & Aggressive Hybrid Funds: Minimum SIPs start at ₹500, with no maximum limit.

Key Insight:

For small savers, PPF and SSY are ideal. For high-income earners, NPS Vatsalya offers unmatched flexibility.

Read More: All About NPS Vatsalya: A Secure Future for Your Child’s Financial Well-Being

Suitability Based on Goals

- NPS Vatsalya: Best for retirement planning, especially for those in higher tax brackets.

- PPF: Ideal for risk-averse investors seeking steady returns.

- SSY: Designed exclusively for parents of girl children.

- Diversified Equity Funds: Suitable for aggressive investors seeking high returns.

- Aggressive Hybrid Funds: Great for moderate-risk investors looking for balanced growth.

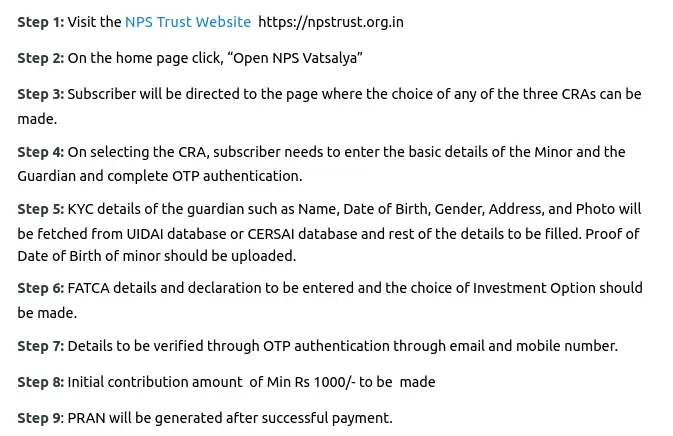

NPS VATSALYA Online Process

Final Thoughts

Choosing the right investment depends on your financial goals, risk appetite, and time horizon. NPS Vatsalya excels as a retirement planning tool, balancing equity growth with debt stability. Meanwhile, PPF and SSY offer conservative and tax-efficient options, and equity-based funds appeal to those willing to embrace market risks for higher returns.

Evaluate your priorities carefully, and diversify your portfolio to achieve a robust and secure financial future.