NPS VATSALYA Launched: In today’s fast-paced world, securing a stable financial future for your child can feel daunting. With increasing education costs and the uncertainty of tomorrow, many parents find themselves searching for effective ways to build a solid financial foundation. Enter NPS VATSALYA, a newly launched scheme designed to give Indian parents peace of mind by safeguarding their children’s financial future.

Try This: NPS Vatsalya Calculator

Launched on September 18, 2024, by Union Finance Minister Nirmala Sitharaman, the NPS VATSALYA scheme encourages disciplined, long-term saving for children up to the age of 18, with the added benefit of compound interest. Whether you’re a new parent or have been considering financial planning for your child, this scheme promises to be a cornerstone for your family’s future.

The Basics of NPS VATSALYA

At its core, NPS VATSALYA (National Pension System Vatsalya) provides a structured saving plan for parents who wish to secure their child’s financial future. The minimum annual contribution starts at ₹1,000, but there’s no upper limit, allowing for flexibility based on your financial capacity.

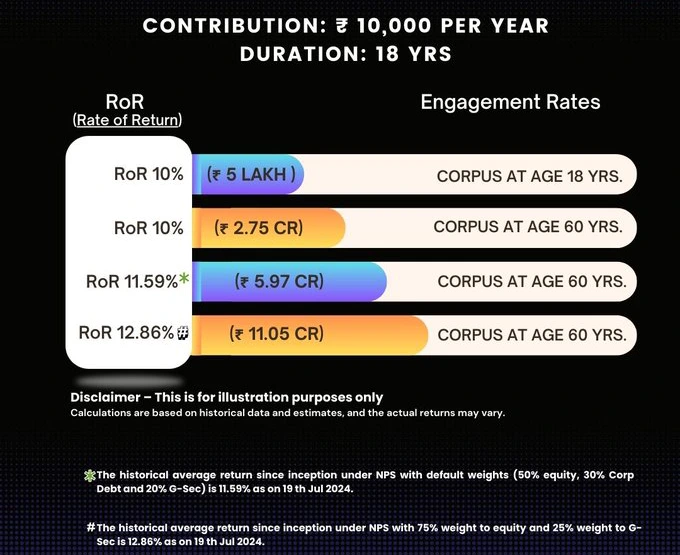

The scheme offers an impressive growth potential, with historical returns showing annual growth rates of up to 12.86% under certain investment options. By investing early and consistently, parents can build a substantial corpus by the time their child reaches 18, providing financial support for higher education, career ambitions, or even emergency medical expenses.

Why Choose NPS VATSALYA for Your Child?

When you think about your child’s future, you want the best for them. NPS VATSALYA provides several key benefits that set it apart from other financial plans:

- Long-term financial security: The scheme fosters disciplined savings and helps build a substantial corpus for your child’s future needs.

- Flexibility: You can tailor your investment strategy through Active Choice or choose from Auto Choice options based on your risk tolerance—whether aggressive, moderate, or conservative.

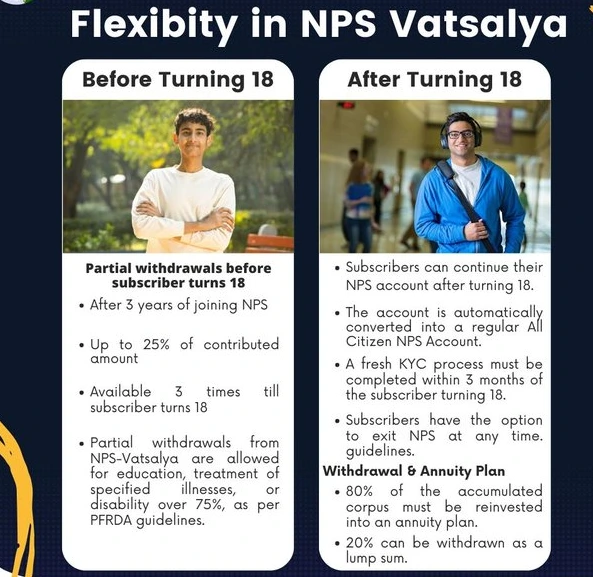

- Partial withdrawals: In case of emergencies or essential expenses like education or medical treatment, you can withdraw funds before your child turns 18.

- Tax benefits: The scheme offers significant tax savings under Section 80C, making it a financially savvy option for parents looking to reduce their tax liability while saving for their child’s future.

Expert Insights: Financial Security with Compound Interest

Financial experts agree that one of the most powerful aspects of the NPS VATSALYA scheme is compound interest. Compound interest means that you earn interest not just on your initial investment but also on the interest accumulated over time. This leads to exponential growth, especially when you invest consistently over long periods.

For instance, if you contribute ₹10,000 annually over 18 years with a 10% return rate, your child’s fund could grow to ₹5 lakh by the time they turn 18. But the power of compounding doesn’t stop there—if you reinvest these funds until your child turns 60, the corpus could potentially grow to over ₹11 crore with the right investment strategy. Financial planner Desai explains: “Starting early and leveraging compound interest is the best gift you can give your child. It ensures financial stability and reduces dependency on loans for education or other expenses later in life.”

Investment Choices Under NPS VATSALYA

One of the standout features of NPS VATSALYA is its flexible investment options. Parents can either make an Active Choice, where they manually choose the asset allocation, or opt for Auto Choice, where the allocation is managed for you based on a predetermined risk profile.

- LC-75 (Aggressive): For those willing to take higher risks in pursuit of higher returns, this option allocates a larger portion of the investment to equities.

- LC-50 (Moderate): A balanced option with equal distribution between equity and debt instruments.

- LC-25 (Conservative): A safer, lower-risk option that prioritizes stable returns over high-risk equities.

Each option is designed to suit different financial goals and risk appetites, ensuring that parents can choose a plan that aligns with their unique needs.

Who Can Join NPS VATSALYA?

NPS VATSALYA is open to Indian citizens under the age of 18. KYC compliance is a requirement, and the scheme is accessible to a wide range of families, regardless of income. It’s especially beneficial for parents who wish to instill financial discipline in their children while ensuring they have the resources to succeed in adulthood.

Real-Life Example: Securing Aman’s Future

Let’s take the case of Rajesh, a small business owner from Mumbai, who started contributing ₹15,000 annually to NPS VATSALYA for his son Aman at the age of 2. Over the course of 16 years, Rajesh’s disciplined approach led to a significant corpus. By the time Aman turned 18, Rajesh had built a fund of ₹8.5 lakh, which he used to cover Aman’s higher education expenses. Today, Aman is financially independent, and the remaining funds are still compounding, giving Aman a head start in life.

Try This: SSY CALCULATOR

Securing the Future with NPS VATSALYA

NPS VATSALYA is more than just a savings plan—it’s a long-term investment in your child’s future. Whether you’re preparing for educational expenses, financial emergencies, or simply ensuring your child has the tools they need to succeed in life, this scheme offers a smart, flexible, and powerful solution. With expert-backed benefits and the magic of compound interest, you can rest assured knowing that you’re making a sound financial decision for your family’s future.

Frequently Asked Questions (FAQs) about NPS VATSALYA

What is NPS VATSALYA?

NPS VATSALYA is a long-term financial savings scheme launched by the Indian government aimed at helping parents build a secure financial future for their children. It allows for flexible contributions starting at ₹1,000 per year, with no upper limit, and offers the benefit of compound interest over time.

Who is eligible to join NPS VATSALYA?

Any Indian citizen under the age of 18 can be enrolled in NPS VATSALYA, provided they meet KYC compliance requirements. Parents or guardians must open and manage the account on behalf of the minor.

What is the minimum contribution required?

The minimum contribution is ₹1,000 per year. There is no maximum limit, giving parents the flexibility to invest according to their financial capabilities.

How long do I need to contribute to NPS VATSALYA?

Parents can contribute to the NPS VATSALYA scheme until the child turns 18. Contributions can continue further if desired, with reinvestment options available for the child’s pension or other financial goals.

What are the investment options under NPS VATSALYA?

NPS VATSALYA offers two main choices:

- Active Choice: Parents can manually select the asset allocation.

- Auto Choice: Choose from three options based on risk tolerance:

- LC-75 (Aggressive)

- LC-50 (Moderate)

- LC-25 (Conservative)

What happens to the account when my child turns 18?

Once the child turns 18, you have the option to exit the scheme and withdraw the accumulated corpus or continue investing for future needs. Reinvestment options for pension schemes or other long-term financial plans are available.

Can I make partial withdrawals from the NPS VATSALYA account?

Yes, partial withdrawals are allowed under certain conditions, such as for education, medical emergencies, or other essential needs before the child turns 18.

What tax benefits do I get with NPS VATSALYA?

Contributions to NPS VATSALYA are eligible for tax deductions under Section 80C of the Income Tax Act. This makes the scheme not only a smart way to save for your child’s future but also a way to reduce your tax liabilities.

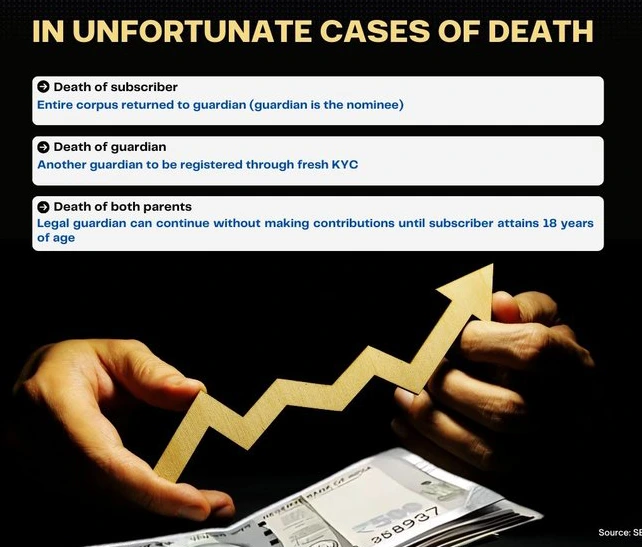

What happens if the subscriber or the guardian passes away?

If the subscriber (child) passes away, the accumulated corpus will be returned to the guardian. If the guardian passes away, a new guardian can be appointed to manage the account. In the event of both parents’ death, the account can be maintained by a legal guardian until the subscriber turns 18.

What are the expected returns from NPS VATSALYA?

While returns are subject to market conditions, the scheme has historically provided returns in the range of 10-12% annually, depending on the chosen investment option. The power of compound interest can significantly boost the final corpus over time.

How do I open an NPS VATSALYA account?

You can open an NPS VATSALYA account through online portals or at designated NPS points of presence (PoPs), which include banks and post offices. KYC documentation will be required during the registration process.

Can I switch between different investment choices?

Yes, NPS VATSALYA allows you to switch between Active and Auto investment choices. This gives you flexibility in adjusting your investment strategy as per your financial goals and risk tolerance.

What happens to the NPS VATSALYA account if I stop contributing?

If contributions are not made for a particular year, the account will remain active but dormant. However, it’s recommended to contribute at least the minimum amount each year to avoid penalties and ensure maximum benefits from the scheme.

Is there a lock-in period for NPS VATSALYA?

The funds are locked in until the subscriber (your child) turns 18. However, partial withdrawals are permitted under specific conditions, as mentioned earlier.

How does NPS VATSALYA help in financial planning for my child’s future?

NPS VATSALYA encourages a disciplined approach to saving for your child’s future. With compound interest and flexible reinvestment options, you can ensure your child has the financial resources needed for education, career, or emergencies as they grow.

By enrolling in NPS VATSALYA, you’re taking a significant step toward ensuring your child’s financial well-being while enjoying the benefits of a smart, tax-saving investment plan.