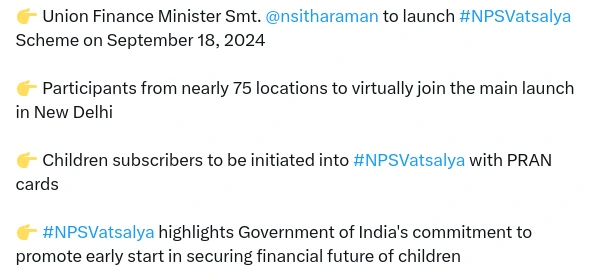

NPS Vatsalya Scheme Details: On September 18, 2024, Union Finance Minister Nirmala Sitharaman will officially launch the NPS Vatsalya Scheme, a groundbreaking initiative aimed at securing the financial futures of India’s younger generation. Introduced as part of the Union Budget 2024-25, this new addition to the National Pension System (NPS) enables parents to open pension accounts for their minor children. In a country where financial planning and security are growing priorities, the NPS Vatsalya Scheme offers a promising tool to instill saving habits and ensure long-term wealth accumulation through the power of compounding.

Try This: NPS Vatsalya Calculator

In this article, we’ll explore the NPS Vatsalya Scheme Details, key features, benefits, and practical implications of the NPS Vatsalya Scheme, giving you a comprehensive understanding of how it fits into the broader landscape of India’s financial market.

What is the NPS Vatsalya Scheme?

The NPS Vatsalya Scheme is a specialized variant of the National Pension System designed exclusively for minors. It allows parents and guardians to open pension accounts for their children and contribute towards their future retirement savings from an early age. This initiative is revolutionary for Indian families, as it emphasizes the importance of starting financial planning early in life.

Read More: Finance Minister to Launch NPS Vatsalya Scheme: Financial Planning for India’s Future

By investing in this scheme, parents can ensure that their children will have a significant corpus ready by the time they reach adulthood, thanks to the scheme’s flexible contribution structure and long-term growth potential.

Key Features of the NPS Vatsalya Scheme

1. Minors’ Eligibility:

Parents or guardians can open accounts for children below 18 years of age. Contributions can be made monthly or annually, depending on the financial capacity of the family.

2. Flexibility in Contributions:

The scheme allows for flexible contributions, with a minimum annual investment of ₹1,000. This makes it accessible to families across different economic backgrounds.

3. Account Conversion at 18:

When the minor reaches the age of 18, the NPS Vatsalya account automatically transitions into a regular NPS account, allowing the young adult to continue managing their pension savings independently.

4. Portability and Long-Term Growth:

The NPS Vatsalya account is portable, which means it remains active regardless of any changes in the parent’s job or location. This ensures continuous savings growth without disruption.

Why the NPS Vatsalya Scheme is a Game Changer

NPS Vatsalya Scheme Details: The NPS Vatsalya Scheme marks a pivotal moment in India’s evolving pension landscape. Traditionally, pension schemes were limited to adult earners, but this initiative breaks that mold by focusing on minors. It ensures that the habit of saving begins early and grows alongside the child, providing significant long-term financial benefits.

For parents, this scheme is a way to secure their child’s future without waiting for adulthood to start planning. By investing as little as ₹1,000 a year, families from all economic backgrounds can participate in this initiative, making it both inclusive and far-reaching.

Benefits of the NPS Vatsalya Scheme

1. Financial Security for Minors:

The scheme ensures that a substantial retirement corpus is built by the time the child reaches adulthood. This provides peace of mind for parents, knowing that their child’s future is financially secure.

2. Encourages Early Savings Habits:

By contributing to the scheme from a young age, children learn the importance of saving and financial planning, setting them up for success in managing their finances as they grow older.

Read More: Unified Pension Scheme: Eligibility Criteria and Future Prospects for NPS Subscribers

3. Long-Term Wealth Accumulation:

With the power of compounding, early contributions lead to significant growth over time. By starting young, the retirement corpus can grow into a substantial amount, ensuring a comfortable retirement for the child.

4. Seamless Transition to Regular NPS Account:

At the age of 18, the NPS Vatsalya account automatically converts into a regular NPS account. This transition is hassle-free and allows the young adult to continue contributing and growing their savings.

How to Apply for the NPS Vatsalya Scheme

The NPS Vatsalya Scheme will be accessible through an online platform, simplifying the application process for parents and guardians. Here’s how you can get started:

1. Visit the Official eNPS Website:

Applications can be submitted online through the official eNPS portal. This makes the process convenient and accessible to families across India.

2. Submit Required Documentation:

Parents or guardians will need to provide necessary documents, including identification for both themselves and the child, to open an account.

3. Make Your Initial Contribution:

The scheme requires a minimum initial contribution of ₹1,000, after which families can decide how frequently they want to make further contributions.

4. Manage the Account:

Once the account is open, you can manage contributions and track your child’s pension savings growth through the same online platform.

Expert Insights: Why Financial Experts Recommend Early Planning

According to Sharma, a leading financial planner, “The NPS Vatsalya Scheme is a breath of fresh air for India’s financial system. By allowing parents to invest in their child’s financial future from an early age, it provides long-term security and peace of mind. The compounding growth is where the real magic happens – start early, and the rewards are immense.”

Sharma’s advice highlights the scheme’s potential to transform how families in India think about financial planning, making it a crucial part of modern financial strategies.

A Future-Oriented Pension Plan for Indian Families

The NPS Vatsalya Scheme is more than just a pension plan; it is a forward-thinking initiative designed to prepare India’s youth for a secure financial future. By encouraging parents to start saving early, the scheme promotes financial literacy and responsible savings habits.

NPS Vatsalya Scheme Details For families looking to ensure their child’s long-term financial well-being, NPS Vatsalya offers a practical, flexible, and highly beneficial solution. It is a small step today that could make a world of difference tomorrow.

Try This: SSY CALCULATOR