NPS Vatsalya Scheme: Exciting news for Indian families! The much-anticipated NPS Vatsalya scheme, announced by Finance Minister Nirmala Sitharaman in the Union Budget 2024, is set to launch in just a couple of weeks. This new initiative promises to transform how we plan for our children’s financial futures. A fresh take on the National Pension Scheme (NPS), NPS Vatsalya Scheme is designed specifically for minors, giving parents and guardians a powerful tool to ensure a stable financial future for their kids.

What You Need to Know About NPS Vatsalya

Who Can Apply?:

This scheme is open to all parents and guardians, whether you're an Indian citizen, an NRI, or an OCI. You can open an NPS Vatsalya account for your minor child with ease.

How Much to Contribute?: You have the flexibility to contribute monthly or annually, right up until your child turns 18. The minimum contribution is just ₹500 per month or ₹6,000 per year.

What Happens at Age 18?:

When your child reaches 18, you can convert their NPS Vatsalya account into a regular NPS account or switch to another plan that suits your needs.

Why It’s Great:

This scheme encourages you to start saving early, helping to cover future expenses like education and marriage. Plus, the contributions come with tax benefits under Section 80CCD, just like the regular NPS.How Does It Work?

Setting up an NPS Vatsalya account is straightforward. You’ll start with a modest contribution and manage the account until your child turns 18. At that point, you can transition the account to a regular NPS plan or explore other options.

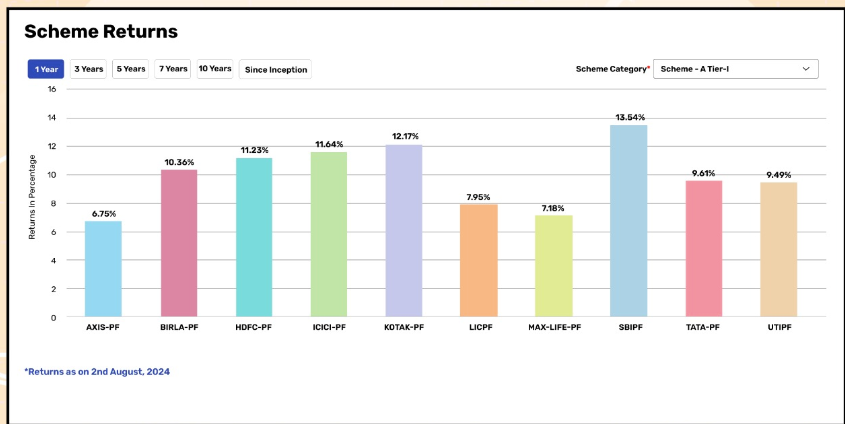

Investment Choices

NPS Vatsalya offers several investment avenues, so you can pick the one that aligns best with your goals:

Equity: For those looking for higher returns over the long term.

Debt: A more conservative choice with stable returns.

Government Securities: A low-risk option for peace of mind.Try This: NPS Vatsalya Calculator

Benefits for You and Your Child

The NPS Vatsalya scheme comes with plenty of perks:

Start Early: It encourages you to begin saving early, setting up a secure financial future for your child.

Flexible Options: Choose from various investment plans and contribution schedules.

Tax Savings: Enjoy tax benefits under Section 80CCD.

Growth Through Compounding: Watch your investment grow with the power of compound interest.How to Get Started

The NPS Vatsalya scheme is launching soon, so get ready! To apply, you’ll likely need to visit the official eNPS website or use your bank’s internet banking portal. To stay updated:

Check the eNPS website for the latest information on the launch and application process.

Contact your bank to find out if they’ll offer the scheme through their online services.Try This: SSY CALCULATOR

Wrap-Up

The NPS Vatsalya scheme is an exciting development that could change how we secure our children’s financial futures. With its flexible contributions, diverse investment options, and tax benefits, it’s a fantastic opportunity for every parent and guardian. Keep an eye out for more updates and get ready to make a smart move for your child’s future!

FAQs

What is NPS Vatsalya?

NPS Vatsalya Scheme is a variant of the National Pension Scheme (NPS) designed for minors, allowing parents and guardians to open an account for their children and contribute to it until they turn 18.

Who is eligible for NPS Vatsalya Scheme?

All parents and guardians, including Indian citizens, NRIs, and OCIs, can open an NPS Vatsalya account for their minor children.

What is the minimum contribution for NPS Vatsalya?

The minimum contribution for NPS Vatsalya Scheme is ₹500 per month or ₹6,000 per year.

Can I withdraw money from NPS Vatsalya?

Withdrawals are allowed only after the child reaches 18 years old, and the account is converted into a regular NPS account or a non-NPS plan.

Is NPS Vatsalya eligible for tax benefits?

Yes, contributions to NPS Vatsalya Scheme are eligible for tax benefits under Section 80CCD, similar to the regular NPS.

How do I open an NPS Vatsalya account?

The application process will be available on the official eNPS website or through certain banks’ internet banking portals, once the scheme is launched.

Can I invest in equity through NPS Vatsalya?

Yes, NPS Vatsalya offers equity as an investment option, ideal for long-term growth.

Is NPS Vatsalya a government-backed scheme?

Yes, NPS Vatsalya Scheme is a government-backed scheme, regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

Can I open multiple NPS Vatsalya accounts for my children?

Yes, parents and guardians can open separate NPS Vatsalya accounts for each of their minor children.

What happens to the NPS Vatsalya account when my child turns 18?

The account can be seamlessly converted into a regular NPS account or a non-NPS plan once the child reaches 18 years old.