Mirae Asset Nifty500 Multicap 50:25:25 ETF has recently made waves in the investment community with its unique approach to diversification and balanced exposure. Launched as India’s first multicap ETF, it aims to provide investors with an opportunity to gain exposure to a broad spectrum of market capitalizations within a single fund. This ETF offers a blend of large-cap, mid-cap, and small-cap stocks, making it a versatile investment choice.

What is Mirae Asset Nifty500 Multicap 50:25:25 ETF?

Definition and Objectives

The Mirae Asset Nifty500 Multicap 50:25:25 ETF is designed to track the Nifty500 Multicap 50:25:25 Total Return Index. This index represents a diversified portfolio of large, mid, and small-cap companies, with the goal of achieving balanced exposure across different market segments. The ETF is an open-ended scheme, which means it will be available for purchase and sale throughout its lifecycle, providing investors with flexibility and liquidity.

Why Consider Investing in Mirae Asset Nifty500 Multicap 50:25:25 ETF?

Balanced Exposure

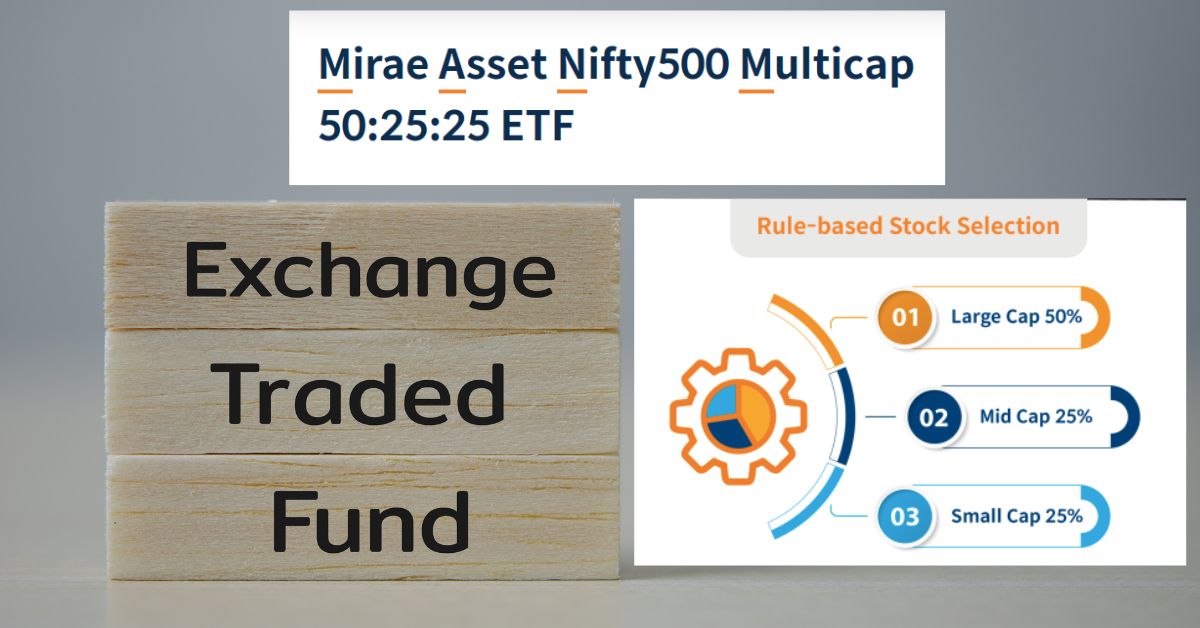

One of the primary advantages of this ETF is its balanced exposure. The fund allocates 50% of its investments in large-cap stocks, 25% in mid-cap stocks, and 25% in small-cap stocks. This structure aims to combine the stability of large-cap stocks with the growth potential of mid and small-cap stocks.

Diversification

By investing in a mix of market caps, the ETF helps in reducing risk through diversification. This approach mitigates the impact of volatility associated with any single market segment, offering a more stable investment option.

Key Details of the ETF

NFO Dates

The New Fund Offer (NFO) for the Mirae Asset Nifty500 Multicap 50:25:25 ETF opens on August 12, 2024, and closes on August 26, 2024. After the NFO period, the scheme will be open for continuous sale and repurchase starting September 2, 2024.

Read More: How to Get a Monthly Pension of Rs 1 Lakh NPS

Allotment Date

The allotment of units for the ETF is scheduled for August 30, 2024. Investors can expect their units to be credited to their accounts on this date.

Minimum Investment

The minimum investment during the NFO is Rs 5,000, with additional investments allowed in multiples of Re 1 thereafter.

Try This: NPS Vatsalya Calculator

Fund Structure and Composition

Large Cap, Mid Cap, Small Cap Breakdown

The ETF’s structure is designed to track the Nifty500 Multicap 50:25:25 Index, which allocates 50% of its weight to large-cap stocks, 25% to mid-cap stocks, and 25% to small-cap stocks. This allocation aims to offer a well-rounded exposure to various segments of the market.

Performance Metrics

Historical Performance

The Nifty500 Multicap 50:25:25 Index has demonstrated a 17.0% compound annual growth rate (CAGR) over the past decade. This performance surpasses the Nifty 50 Index by 3.2% and the Nifty 500 Index by 1.5%, showcasing its strong track record.

Benchmark Analysis

Nifty500 Multicap 50:25:25 vs. Nifty 50, Nifty 500

The ETF is benchmarked against the Nifty500 Multicap 50:25:25 Index. Compared to the Nifty 50 and Nifty 500 indices, it offers a more balanced exposure across different market caps, potentially leading to better risk-adjusted returns.

Try This: SSY CALCULATOR

Risk Factors and Diversification

Understanding Risk

While the ETF provides diversification, it is essential for investors to understand the risks associated with market fluctuations. The blend of large, mid, and small-cap stocks aims to mitigate some of these risks, but market volatility can still impact returns.

Benefits of Diversification

Diversification helps in reducing the overall risk of the investment portfolio. By including stocks from different market segments, the ETF balances the risks and potential rewards associated with each segment.

Sectoral Exposure

Sector Distribution

The ETF’s exposure spans various sectors, providing investors with a diversified sectoral allocation. Key sectors include financial services, information technology, healthcare, and consumer goods.

Key Sectors Covered

The major sectors in the ETF’s portfolio are financial services (25.1%), capital goods (8.8%), information technology (8.3%), and healthcare (7.1%). This sectoral spread enhances the fund’s ability to capture growth across different areas of the economy.

Top Holdings in the ETF

Major Companies

The top holdings in the Mirae Asset Nifty500 Multicap 50:25:25 ETF include leading companies such as HDFC Bank Ltd., Reliance Industries Ltd., and Infosys Ltd. These companies are major contributors to the ETF’s performance.

Their Weightage

The ETF has significant weightage in top companies, with HDFC Bank Ltd. having a 4.4% weight, Reliance Industries Ltd. at 3.7%, and Infosys Ltd. at 3.1%.

Investment Strategy and Approach

How the ETF Replicates the Index

The Mirae Asset Nifty500 Multicap 50:25:25 ETF aims to replicate the performance of the Nifty500 Multicap 50:25:25 Index by investing in the same proportion of stocks. This strategy ensures that the ETF closely tracks the index’s performance.

Comparison with Other Multicap ETFs

Advantages and Disadvantages

Compared to other multicap ETFs, the Mirae Asset Nifty500 Multicap 50:25:25 ETF offers a unique blend of large, mid, and small-cap stocks. This diversified approach may provide better risk-adjusted returns but also comes with its own set of risks and benefits.

How to Invest in Mirae Asset Nifty500 Multicap 50:25:25 ETF

Investment Process

Investors can participate in the NFO by submitting their applications through authorized channels. The minimum investment amount is Rs 5,000, and additional investments can be made in multiples of Re 1.

Required Documents

To invest, individuals need to provide necessary documents such as PAN card, Aadhaar card, and proof of address.

Tax Implications of Investing in ETFs

Capital Gains Tax

Investors should be aware of capital gains tax on their earnings. Long-term capital gains are generally taxed at a lower rate compared to short-term gains.

Dividend Tax

Dividends received from the ETF are also subject to tax, and investors should factor this into their investment decisions.

FAQs

What is the Mirae Asset Nifty500 Multicap 50:25:25 ETF?

The Mirae Asset Nifty500 Multicap 50:25:25 ETF is an open-ended fund designed to track the Nifty500 Multicap 50:25:25 Total Return Index, offering balanced exposure to large, mid, and small-cap stocks.

When is the NFO for this ETF?

The NFO period is from August 12, 2024, to August 26, 2024, with the scheme re-opening for continuous sale and repurchase from September 2, 2024.

What is the minimum investment required?

The minimum investment during the NFO is Rs 5,000, with additional investments allowed in multiples of Re 1.

What are the benefits of investing in this ETF?

The ETF provides balanced exposure to different market caps, which can help in diversifying risk and potentially enhancing returns.

How is this ETF different from other multicap ETFs?

This ETF tracks a unique index with a specific allocation of 50% large-cap, 25% mid-cap, and 25% small-cap stocks, offering a distinct diversification strategy.

What are the tax implications of investing in ETFs?

Investors may need to pay capital gains tax on profits and dividend tax on earnings from the ETF.

Nifty500 Multicap 50:25:25 Index

The Mirae Asset Nifty500 Multicap 50:25:25 ETF represents a significant innovation in India’s investment landscape, offering a balanced approach to market exposure. Its diversified structure and alignment with the Nifty500 Multicap 50:25:25 Index make it a compelling choice for investors seeking a mix of stability and growth potential. As with any investment, it’s essential to assess your financial goals and risk tolerance before investing.

Mirae Asset Nifty500 Multicap 50:25:25 ETF PRODUCT LEAFLET

Read More: New Pension Scheme ‘NPS Vatsalya’ Launched for Minors: A Future Investment Opportunity