Indian parents prioritize their children’s future above almost every other financial milestone. You likely find yourself calculating the skyrocketing costs of higher education as your toddler grows. Recent data from December 2025 reveals a massive shift in how households approach this goal. The number of folios in solution-oriented children’s funds recently touched 32 lakhs. This surge reflects a growing realization that traditional savings accounts cannot keep pace with the rising costs of degrees.

Read More: Investment Lessons From 2025 & High-Alpha Ideas For 2026

The Rise of Solution-Oriented Investing

Investors moved their capital into these specialized schemes at an unprecedented rate lately. The Assets Under Management (AUM) for the category stood at roughly ₹9,800 crores in November 2020. By November 2025, that figure reached approximately ₹26,000 crores. This represents a 160% rise within five years.

Finance Expert Prain Bachai, founder at FinFix Research and Analytics, points out that these funds offer a psychological bridge. The name itself creates a mental silo for the investor. You stay committed to the goal since the fund’s purpose remains clear. These schemes come with a mandatory lock-in period of five years or until the child reaches eighteen years of age. This restriction acts as a forced discipline mechanism. It prevents you from dipping into the corpus for impulsive purchases or minor emergencies.

Combating Education Inflation in India

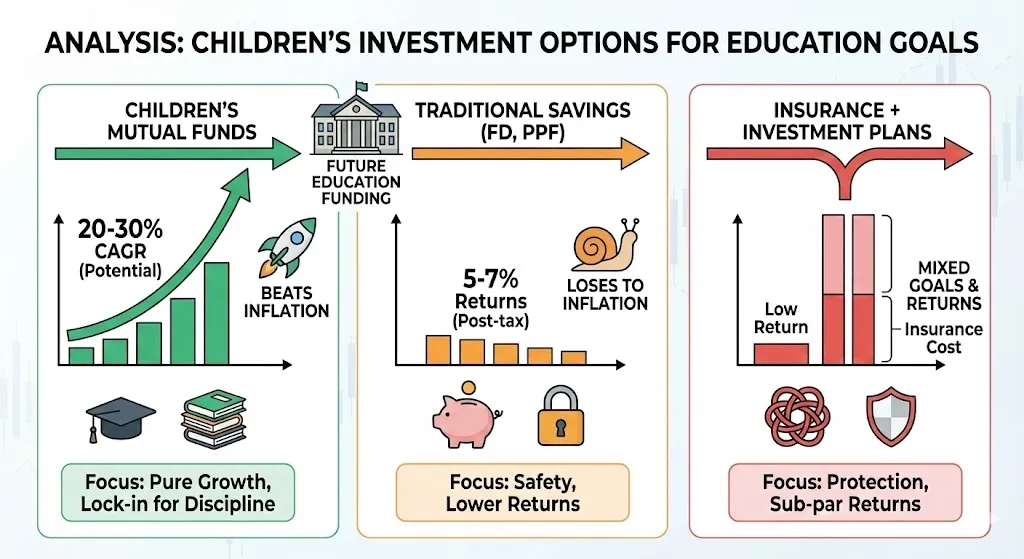

Standard inflation numbers rarely tell the full story of schooling costs. Education inflation in India currently hovers between 10% and 12%. This means your child’s college fees will likely double every six or seven years. Fixed deposits (FDs) often struggle to provide real positive returns after taxes. If your FD earns 7% and you fall in a high tax bracket, your post-tax return drops to 4.9%. You effectively lose purchasing power against double-digit inflation.

Try This: NPS Vatsalya Calculator

Equity exposure remains the primary vehicle to outrun these rising costs. Over the last three to five years, top-performing children’s mutual funds delivered a Compound Annual Growth Rate (CAGR) between 20% and 30%. These returns dwarf traditional saving methods. Finance Expert Bachai emphasizes that while one-year returns might fluctuate, the five-year horizon typically provides the growth needed for significant goals.

Understanding the Structure: 12 Specialized Schemes

The market currently hosts only twelve schemes in this category. This thin entry list surprises many, given the category’s potential. Two fund houses, SBI and UTI, even offer multiple variations within their offerings. The structure varies significantly across these twelve funds. Some track a flexi-cap approach, while others mimic aggressive hybrid structures.

- SBI Magnum Children’s Benefit Fund: A consistent performer with a long track record.

- HDFC Children’s Gift Fund: Known for maintaining stability through market cycles.

- ICICI Prudential Child Care Fund: Often utilized by those seeking aggressive equity exposure.

- Tata Children’s Asset Allocation Fund: Provides a structured approach to asset balancing.

- UTI Children’s Career Fund: Offers options tailored to different risk appetites.

You must examine the underlying portfolio before committing capital. A debt-oriented children’s fund will behave differently than an equity-heavy one.

Insurance vs. Investment: Clearing the Confusion

Many parents mistakenly bundle insurance and investment through child-specific plans. This approach often leads to sub-par returns and high transparency issues. A pure investment product provides the clarity you need regarding future value. Finance Expert insights suggest keeping insurance restricted to term plans or health covers for risk management. Use mutual funds as your growth engine.

Imagine your child is three years old today. A college course costing ₹40 lakhs now will cost roughly ₹1.67 crores in fifteen years. To reach that target with a 12% annual return, you need a monthly SIP of about ₹35,000. If you choose lower-yield products like PPF or certain government schemes, your monthly investment requirement could jump to ₹42,000 or more. Lower risk always demands higher capital outflows to reach the same destination.

The Path Forward

Discipline remains the cornerstone of wealth creation. The lock-in period of these funds helps you stay invested through market volatility and corrections. You avoid the temptation to chase the “fund of the month” and instead focus on the long-term recovery cycles.

Whether you choose a dedicated children’s fund or build a parallel portfolio using index funds and flexi-cap schemes, the objective stays the same. You are buying your child the freedom to choose their career without financial constraints. Start your SIP today to leverage the power of compounding.

Read More: EPFO 3.0 Features and Launch: What You Need to Know in 2025