NPS for Minors: Planning for your child’s financial future can be one of the most important decisions you’ll ever make. In India, where financial security is key to a stable future, one of the most powerful tools available is the National Pension System (NPS). But did you know that NPS isn’t just for adults? With the introduction of NPS Vatsalya, minors can now also benefit from this secure and flexible savings plan, setting them on the right path toward financial independence.

What is NPS for Minors?

NPS for minors, often referred to as NPS Vatsalya, is a pension scheme designed for children below 18 years of age. It allows parents or guardians to open and manage an NPS account for their child, making early investments that could secure their financial future. By contributing regularly to this account, parents can build a substantial retirement corpus for their children while also teaching them valuable lessons in long-term financial planning.

Try This: NPS Vatsalya Calculator

Why Choose NPS for Your Child?

There are several compelling reasons to consider NPS Vatsalya for your minor child:

1. Financial Security at a Young Age

Starting an NPS account early means your child benefits from the power of compound interest. The longer the money stays invested, the more it grows. With a small annual contribution of as little as ₹1,000, you can build a significant corpus by the time your child reaches adulthood.

2. Teach Financial Responsibility

An NPS account helps introduce the concept of pension planning early in life. By the time your child reaches adulthood, they’ll have a clear understanding of how long-term investments work, setting them on a disciplined financial journey.

3. Flexibility and Control

As a guardian, you can choose from various investment options in NPS, such as Active Choice or Auto Choice. These options allow you to decide how your contributions are invested across equity, corporate bonds, and government securities. Once your child turns 18, they take control of the account and can continue contributing based on their financial goals.

Read More:NPS Vatsalya Tax Benefits: Securing Your Child’s Future with Tax Savings

How Does NPS for Minors Work?

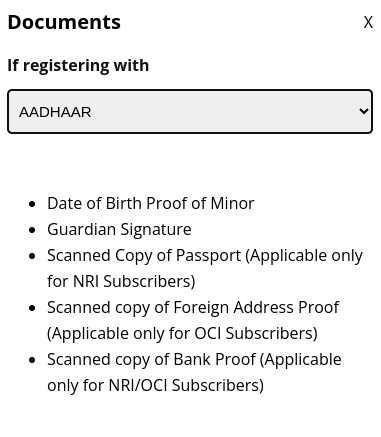

Opening an NPS Vatsalya account is a straightforward process. As a parent or guardian, you’ll need to provide some basic documents like your Aadhaar and PAN card and complete a Know Your Customer (KYC) process. Once the account is opened, you can start making contributions.

Key Features of NPS Vatsalya:

- Minimum Contribution: ₹1,000 per year.

- No Maximum Contribution Limit: You can contribute as much as you want, based on your financial ability.

- Partial Withdrawals: After three years, you can withdraw up to 25% of the contributed amount for your child’s education or medical emergencies.

- Death Benefit: In case of unfortunate events like the death of the guardian or subscriber, provisions are in place to protect the account and ensure that the child’s financial future remains secure.

The Power of Long-Term Investment

One of the biggest advantages of NPS for minors is the potential to accumulate substantial wealth over time. The longer the investment period, the greater the impact of compound interest. To illustrate:

If you contribute ₹10,000 per year for 18 years, the corpus at 18 years could be around ₹5 lakh, and by the time your child turns 60, it could grow to over ₹2.75 crore at a 10% rate of return. With the option of investing in a mix of equity and debt, NPS has historically delivered solid returns.

Read More: NPS Vatsalya: Ensuring Retirement Security for India’s Future Generations

Is NPS for Minors Right for You?

You may be wondering whether NPS for minors is the right choice for your family. Let’s look at some scenarios where it can be particularly beneficial:

- You want to instill financial discipline early: NPS Vatsalya helps your child understand the importance of long-term savings and investing.

- You want to start small but aim big: With low initial contributions and flexible options, it’s an accessible plan for families of all income levels.

- You want tax benefits: Although tax benefits are typically for adult accounts, investing early in NPS can still provide peace of mind and long-term financial stability for your child.

Real-Life Example: Early Start, Big Rewards

Consider Ananya’s story: her parents opened an NPS account for her when she was just 5 years old. They contributed ₹5,000 annually for 13 years. By the time she turned 18, Ananya had over ₹1 lakh saved up, thanks to the power of compounding. Not only was her college fund sorted, but she also had a valuable financial asset she could control. Now, at 25, Ananya continues to contribute to the same NPS account and plans to use it for her retirement.

Final Thoughts

NPS for minors is not just an investment; it’s a long-term commitment to your child’s future financial security. By starting early, you give them the advantage of time, compound interest, and a disciplined approach to savings. Whether it’s for education, medical emergencies, or long-term retirement goals, NPS Vatsalya provides a flexible, reliable, and secure way to invest in your child’s future.

So, why wait? Start planning for your child’s financial independence today by exploring NPS for minors.

Read More: All About NPS Vatsalya: A Secure Future for Your Child’s Financial Well-Being