Understanding the Unified Pension Scheme (UPS)

The Indian government’s recent announcement of the Unified Pension Scheme (UPS) has sparked significant interest and debate among government employees. This new scheme is set to replace the existing National Pension System (NPS) for eligible individuals, aiming to provide a more secure and unified retirement plan. In this article, we will delve into the intricacies of the Unified Pension Scheme, exploring its features, eligibility criteria, and potential impact on government employees’ financial well-being.

What is the Unified Pension Scheme?

The Unified Pension Scheme, as its name suggests, is an endeavor to create a single, comprehensive pension system for all government employees across India. This scheme aims to address some of the perceived shortcomings of the previous pension schemes and provide a more equitable and transparent retirement plan for those who dedicate their services to the nation.

Try This: Unified Pension Scheme Calculator

Historical Background of Pension Schemes in India

To fully appreciate the significance of the Unified Pension Scheme, it’s crucial to understand the evolution of pension schemes in India. Before the implementation of the National Pension System (NPS) in 2004, government employees primarily benefited from the Defined Benefit Pension Scheme (DBPS), also known as the Old Pension Scheme.

Under the DBPS, retirees received a guaranteed pension amount, usually 50% of their last drawn salary, regardless of their contributions during their service years. While this scheme provided a sense of security and stability to retirees, it placed a significant financial burden on the government, particularly with increasing life expectancy and a growing retired population.

Try This: SSY CALCULATOR

The introduction of the NPS in 2004 marked a significant shift from the DBPS. The NPS is a defined-contribution pension scheme where both the employee and the government contribute a predetermined percentage of the employee’s salary to a pension fund. Upon retirement, employees receive a pension based on the corpus accumulated in their pension account, which depends on the contributions made and the returns generated by the chosen investment options.

While the NPS aimed to create a more sustainable pension system, it faced criticism for its market-linked nature, where pension payouts are not guaranteed and fluctuate based on market performance. This uncertainty raised concerns among employees accustomed to the guaranteed pension under the DBPS.

**Read More: Best Investment Options for Financial Independence 2024: Top 5 Choices

The Need for a Unified Pension System

The decision to introduce the Unified Pension Scheme stems from the government’s intent to address the concerns and challenges posed by the existing pension schemes while ensuring a financially secure future for government employees.

Here are some of the key reasons why a unified pension system like the UPS is deemed necessary:

- Equity and Uniformity: The UPS aims to bring all government employees under a single pension umbrella, ensuring consistency and fairness in pension benefits across different departments and levels of service. This eliminates disparities and ensures that every employee receives a pension commensurate with their contributions and years of service.

- Financial Sustainability: By adopting a defined-contribution approach similar to the NPS, the UPS aims to create a more financially viable pension system. The contributions made by both the employee and the government are invested, and the pension payout is linked to the corpus accumulated, making the system less burdensome on the government’s finances in the long run.

- Flexibility and Choice: While the specific details of the UPS are yet to be fully revealed, it is expected to offer employees some degree of flexibility in managing their pension savings. This could include options to choose from different investment portfolios based on their risk appetite and financial goals.

Key Features of the UPS

The Unified Pension Scheme comes with several key features designed to provide financial security and peace of mind to government employees during their retirement years.

Assured Pension: How It Works

One of the most significant features of the UPS is the concept of an “assured pension.” Unlike the market-linked returns of the NPS, the UPS is expected to offer a guaranteed minimum pension amount to retirees. This means that regardless of market fluctuations, employees will receive a predetermined minimum pension, ensuring a basic standard of living during retirement.

Family Pension: Ensuring Financial Security for Dependents

The UPS recognizes the importance of family well-being and provides provisions for family pensions. In the unfortunate event of an employee’s demise, their spouse or dependents will be entitled to receive a portion of the pension, ensuring their financial security. The family pension amount is typically calculated as a percentage of the employee’s pension and is subject to specific rules and regulations.

Minimum Pension Guarantee: A Safety Net

To further strengthen the social security aspect of the UPS, a minimum pension guarantee is expected to be incorporated into the scheme. This guarantee will ensure that even if an employee’s accumulated pension corpus is insufficient to generate a substantial pension income, they will still receive a minimum guaranteed pension amount, providing a crucial safety net for lower-income retirees.

Inflation Protection: Safeguarding Your Savings

Recognizing the erosive effect of inflation on purchasing power, the UPS is expected to incorporate measures to protect pension savings from inflation. This could involve indexing pension payouts to inflation or providing regular dearness allowances to ensure that the value of the pension keeps pace with rising prices.

Lump-Sum Payment: Additional Financial Benefits

In addition to the regular pension payouts, the UPS may also include provisions for a lump-sum payment to retirees upon superannuation. This lump-sum amount can be utilized by retirees for various purposes, such as meeting immediate financial obligations, making investments, or pursuing personal aspirations.

Read More: Unified Pension Scheme: Secure Your Future with Assured Benefits

Eligibility and Enrollment for UPS

As the Unified Pension Scheme is still in its nascent stages, the specific eligibility criteria and enrollment process have not been officially announced. However, based on the government’s statements and the objectives of the scheme, it is anticipated that the following categories of individuals will be eligible to join the UPS:

- New Government Employees: All individuals joining government service after the implementation date of the UPS will be automatically enrolled in the scheme. This ensures that all new entrants to the public sector are covered under the unified pension system.

- Existing NPS Subscribers: Government employees who are currently covered under the National Pension System are likely to have the option to switch to the UPS. The modalities of this transition, including any potential benefits or drawbacks, will be clarified in due course by the relevant authorities.

UPS vs. NPS: A Comparative Analysis

With the introduction of the UPS, it’s natural for government employees to compare it with the existing National Pension System (NPS) to understand the key differences and implications for their retirement planning.

Contribution Rates and Structure

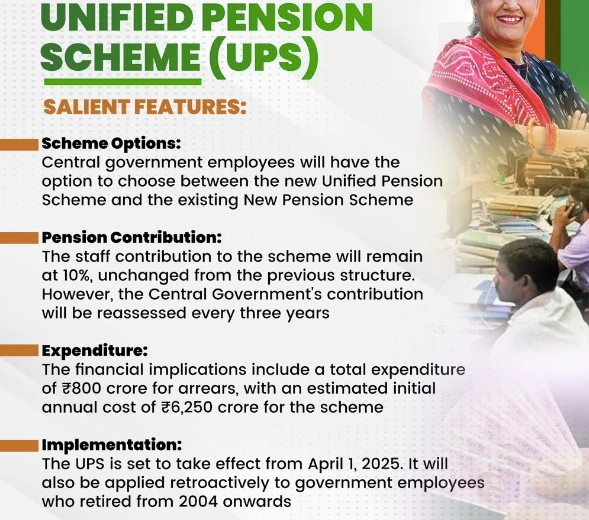

Under the NPS, both the employee and the government contribute a predetermined percentage of the employee’s salary to the pension fund. The current contribution rate for employees is 10% of their basic salary and dearness allowance, while the government contributes 14%.

The contribution structure for the UPS is yet to be officially announced, but it is widely speculated that the government might increase its contribution rate to provide more significant retirement benefits. Any changes in the employee contribution rate will be closely watched and analyzed for their impact on take-home salaries.

Pension Calculation Formulae

The pension calculation methods for the UPS and NPS differ significantly. Under the NPS, the pension amount is determined based on the corpus accumulated in the employee’s pension account upon retirement. This corpus is dependent on the contributions made, the returns generated on investments, and the annuity plan chosen at the time of retirement.

The UPS, with its emphasis on an assured pension, is expected to adopt a different pension calculation formula. While the exact details are yet to be revealed, it is anticipated that the pension amount will be linked to the employee’s salary history, years of service, and potentially other relevant factors.

Investment Options and Risk Appetite

The NPS provides employees with a degree of flexibility in managing their pension savings by offering a choice between different investment funds. These funds typically invest in a mix of asset classes such as equities, government bonds, and corporate bonds, allowing employees to tailor their investments based on their risk tolerance and investment horizon.

The investment options and level of control offered to employees under the UPS are still under deliberation. The government may choose to maintain a similar structure as the NPS, offering a range of investment funds, or opt for a more streamlined approach with limited investment choices.

Withdrawal and Exit Rules

The NPS has specific rules regarding withdrawals and exits from the scheme. Employees are allowed to withdraw a portion of their accumulated corpus for specific purposes, such as home purchases, children’s education, or medical emergencies, subject to certain conditions and limits. Upon retirement, a significant portion of the corpus must be used to purchase an annuity, which provides a regular pension income.

The withdrawal and exit rules for the UPS are yet to be defined and will likely be outlined in the scheme’s official guidelines. The government may choose to align the UPS’s withdrawal rules with those of the NPS or introduce new provisions based on the scheme’s objectives.

Impact of UPS on Government Employees

The implementation of the Unified Pension Scheme is expected to have a multi-faceted impact on government employees, influencing their financial planning, retirement outlook, and overall morale.

Financial Security and Retirement Planning

One of the most significant impacts of the UPS will be on the financial security and retirement planning of government employees. The assured pension feature, if implemented as anticipated, will provide a greater sense of certainty and stability compared to the market-linked returns of the NPS. Knowing that they will receive a guaranteed minimum pension will allow employees to plan their post-retirement finances more effectively and make informed decisions about their savings and investments.

Impact on Employee Morale and Productivity

The introduction of a unified and potentially more beneficial pension scheme is likely to boost the morale and motivation of government employees. A secure and predictable retirement plan can enhance job satisfaction and create a more positive work environment.

Unified Pension Scheme: FAQs

What happens to my existing NPS account if I switch to the UPS?

The process of transitioning from NPS to UPS and the implications for existing NPS accounts are yet to be clarified. The government is expected to issue detailed guidelines outlining the transfer process, any potential tax implications, and the treatment of accumulated corpus in NPS accounts.

Will the UPS be applicable to employees of state governments as well?

The initial announcement of the UPS focuses on its implementation for central government employees. However, the government has indicated that a similar structure could be adopted by state governments. The decision to implement the UPS will ultimately rest with individual state governments, and the timeline for implementation may vary.

How will the UPS be funded, and will it be sustainable in the long run?

The funding mechanism and long-term sustainability of the UPS will depend on various factors, including the chosen contribution rates, the pension calculation formula, and the overall economic conditions. The government will need to carefully consider these factors to ensure the scheme’s viability and prevent any potential strain on government finances in the future.

Can I choose to remain under the NPS even after the implementation of the UPS?

The government is expected to provide a choice to existing NPS subscribers regarding switching to the UPS. Employees who are satisfied with the NPS and its features may choose to remain under the existing scheme. However, the details regarding the choice period and any potential implications for remaining under the NPS will be clarified in the official guidelines.

Will the UPS cover contractual or outsourced employees in government departments?

The current scope of the UPS appears to be limited to regular government employees. The coverage of contractual or outsourced employees is unclear at this stage and may depend on future government decisions and policy changes.

How can I stay updated on the latest developments and announcements regarding the UPS?

Government employees are advised to refer to official government websites, notifications, and circulars for the most accurate and up-to-date information on the Unified Pension Scheme. The Department of Pension & Pensioners’ Welfare and the Ministry of Finance are likely to be the primary sources of information on the UPS.