The Unified Pension Scheme (UPS) represents a significant step forward in securing the financial futures of government employees in India. Cabinet has approved the Unified Pension Scheme (UPS), Introduced by the Prime Minister Narendra Modi-led Cabinet, this scheme offers a host of benefits, including an assured pension, family pension, and minimum pension guarantee. Unlike previous pension schemes, the UPS is designed to provide greater financial security and stability to retirees, ensuring that they can live comfortably post-retirement.

In this comprehensive guide, we’ll explore every aspect of the Unified Pension Scheme, from its key features and eligibility criteria to its impact on financial planning and tax implications. Whether you’re a government employee considering enrollment or simply interested in understanding how the scheme works, this article will provide you with all the information you need.

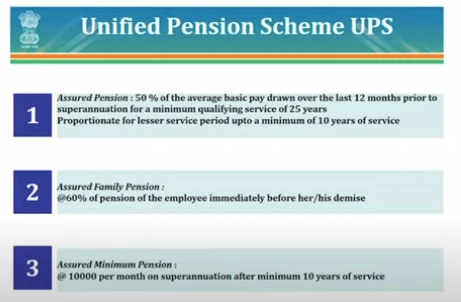

Key Features of the Unified Pension Scheme

Assured Pension: Understanding the Basics

The cornerstone of the Unified Pension Scheme is its assured pension feature. Under this scheme, government employees who have completed a minimum of 25 years of service are entitled to receive 50% of their average basic pay drawn over the last 12 months before retirement. This guaranteed income provides retirees with the financial stability they need to maintain their standard of living after leaving the workforce.

Read More: New Pension Scheme ‘NPS Vatsalya’ Launched for Minors: A Future Investment Opportunity

Family Pension: What Happens After the Employee’s Demise

In the unfortunate event of the pensioner’s death, the scheme ensures that their family is not left without support. The Unified Pension Scheme provides a family pension, which is calculated as 60% of the pension that the employee was receiving at the time of their demise. This benefit is crucial for ensuring the financial well-being of the pensioner’s dependents.

Minimum Pension Guarantee

One of the standout features of the Unified Pension Scheme is its minimum pension guarantee. Regardless of the length of service, employees are assured a minimum pension of ₹10,000 per month, provided they have completed at least 10 years of service. This provision ensures that even those with shorter service periods are not left without adequate financial support in their retirement years.

Try This: NPS Vatsalya Calculator

Eligibility Criteria for the Unified Pension Scheme

Minimum Service Requirement

To qualify for the full benefits of the Unified Pension Scheme, an employee must have completed a minimum of 25 years of service. This criterion is essential for ensuring that the pension amount is substantial enough to support the retiree throughout their post-employment life.

Proportional Benefits for Lesser Service

Employees who have served for less than 25 years are still eligible for pension benefits under the UPS, albeit on a proportional basis. The pension amount is adjusted according to the number of years of service, ensuring fairness and inclusivity within the scheme.

Try This: SSY CALCULATOR

Special Provisions for Early Retirement

The scheme also includes provisions for early retirement, where employees with at least 10 years of service can still receive pension benefits, although these may be reduced in proportion to the shorter service period. This flexibility is particularly important for those who may need to retire earlier due to health or personal reasons.

Calculation of Pension under the Unified Pension Scheme

Formula for Pension Calculation

The pension under the Unified Pension Scheme is calculated using a specific formula: 50% of the average basic pay drawn over the last 12 months before retirement. This formula ensures that the pension amount is reflective of the employee’s most recent earnings, providing a fair and equitable outcome.

Average Basic Pay: A Crucial Component

The average basic pay is a critical factor in determining the pension amount. It represents the employee’s earnings during the last 12 months of service, which is then used to calculate 50% of this average as the pension. This method ensures that the pension reflects the employee’s most recent financial status.

Proportional Pension for Less Than 25 Years of Service

For employees with less than 25 years of service, the pension amount is calculated on a proportional basis. The percentage of the average basic pay used in the formula is adjusted according to the number of years served, ensuring that even those with shorter careers receive fair compensation.

Family Pension under the Unified Pension Scheme

Calculating the Family Pension

The family pension is a vital component of the Unified Pension Scheme, ensuring that the employee’s dependents are supported after their death. The family pension is calculated as 60% of the pension that the employee was receiving at the time of their demise, providing a stable income for the surviving family members.

**Read More: Best Investment Options for Financial Independence 2024: Top 5 Choices

Benefits to Dependents

The family pension under the UPS is designed to support the dependents of the deceased employee, including spouses, children, and in some cases, dependent parents. This benefit is crucial for maintaining the family’s financial stability during difficult times.

Transition from Employee to Family Pension

The transition from the employee’s pension to the family pension is a seamless process under the Unified Pension Scheme. Upon the death of the pensioner, the family pension automatically comes into effect, ensuring that there is no gap in financial support for the dependents.

Minimum Pension Assurance

Importance of Minimum Pension

The minimum pension guarantee of ₹10,000 per month is a critical feature of the Unified Pension Scheme. It ensures that all eligible retirees, regardless of their length of service, receive a baseline level of financial support. This provision is particularly important for those with shorter service periods who may not have accumulated enough pension benefits through the regular formula.

Read More: How to Get a Monthly Pension of Rs 1 Lakh NPS

₹10,000 per Month: Assured Minimum Pension

The scheme guarantees a minimum pension of ₹10,000 per month for all eligible retirees, provided they have completed at least 10 years of service. This assurance provides a safety net for those who may not qualify for a higher pension due to shorter service periods.

Conditions for Availing Minimum Pension

To avail of the minimum pension, employees must meet specific conditions, including completing at least 10 years of service and retiring from a government position. These criteria are designed to ensure that the minimum pension is awarded fairly and equitably.

Inflation Indexation in the Unified Pension Scheme

Dearness Relief and Inflation Indexation

To protect the purchasing power of pensioners, the Unified Pension Scheme includes provisions for inflation indexation through dearness relief. This adjustment is based on the All India Consumer Price Index (AICPI-W) and is reviewed periodically to ensure that pensions keep pace with rising costs.

AICPI-W: Understanding the Index Used

The AICPI-W (All India Consumer Price Index for Industrial Workers) is the index used to calculate dearness relief under the Unified Pension Scheme. This index measures inflation and is a key tool in ensuring that pensions remain sufficient to cover the cost of living.

Impact of Inflation on Pensions

Inflation can erode the purchasing power of fixed incomes, making inflation indexation an essential feature of the Unified Pension Scheme. By tying dearness relief to the AICPI-W, the scheme ensures that pensioners are protected from the adverse effects of inflation.

Comparison with Previous Pension Schemes

Old Pension Scheme vs Unified Pension Scheme

The Unified Pension Scheme offers several advantages over the Old Pension Scheme, including a guaranteed minimum pension, family pension benefits, and inflation indexation. These features make the UPS a more robust and reliable option for retirees.

New Pension Scheme (NPS) vs Unified Pension Scheme

While the New Pension Scheme (NPS) is a defined contribution plan, the Unified Pension Scheme is a defined benefit plan, providing a guaranteed pension amount. This key difference makes the UPS a more attractive option for those seeking financial stability in retirement.

Comparative Benefits

The benefits of the Unified Pension Scheme, including the assured pension, family pension, and inflation protection, make it a more comprehensive and secure option compared to previous pension schemes. The UPS offers a higher level of financial security, particularly for those with long service periods.

How to Enroll in the Unified Pension Scheme

Enrollment Process for Government Employees

Government employees can enroll in the Unified Pension Scheme through their respective departments. The enrollment process involves submitting the necessary documentation and completing the required forms, ensuring that all eligible employees can access the scheme’s benefits.

Necessary Documentation

To enroll in the Unified Pension Scheme, employees must provide specific documentation, including proof of service, identification documents, and salary details. These documents are used to verify eligibility and calculate the pension amount.

Online Enrollment: A Step-by-Step Guide

The Unified Pension Scheme also offers an online enrollment option, allowing employees to complete the process from the comfort of their homes. This step-by-step guide will walk you through the online enrollment process, ensuring a smooth and hassle-free experience.

Case Studies: Benefits of the Unified Pension Scheme

Case Study 1: 25 Years of Service

In this case study, we’ll explore how an employee with 25 years of service benefits from the Unified Pension Scheme, including the calculation of their pension and the impact of family pension provisions.

Case Study 2: 15 Years of Service

This case study examines the pension benefits for an employee with 15 years of service, highlighting the proportional pension calculation and the minimum pension guarantee.

Case Study 3: Early Retirement

In this scenario, we’ll look at the benefits of the Unified Pension Scheme for an employee who retires early, including the impact on their pension and family pension benefits.

Impact of Unified Pension Scheme on Employees’ Financial Planning

Long-term Financial Security

The Unified Pension Scheme plays a crucial role in providing long-term financial security for retirees. By offering an assured pension, the scheme helps employees plan for a financially stable retirement.

Pension as a Retirement Planning Tool

Pensions are a vital component of retirement planning, and the Unified Pension Scheme provides a reliable source of income that can be factored into an employee’s overall financial plan.

Role in Household Financial Stability

The financial stability provided by the Unified Pension Scheme extends beyond the individual retiree to their household, ensuring that dependents are also supported through family pension benefits.

Tax Implications of the Unified Pension Scheme

Tax Benefits on Pension Income

The pension income received under the Unified Pension Scheme is subject to tax, but there are specific tax benefits available that can help retirees reduce their tax liability. Understanding these tax implications is crucial for effective financial planning.

Tax Treatment of Family Pension

Family pension received by dependents is also subject to tax, but at a concessional rate. This section will explore the tax treatment of family pension and how dependents can maximize their benefits.

Understanding Tax Deductions

There are several tax deductions available to retirees under the Unified Pension Scheme, including deductions for medical expenses and contributions to pension funds. This section will provide an overview of these deductions and how to claim them.

Unified Pension Scheme vs National Pension Scheme (NPS)

Key Differences

The Unified Pension Scheme and the National Pension Scheme (NPS) are two distinct retirement plans with different features and benefits. This section will compare the key differences between the two schemes, helping you determine which is best for your retirement planning needs.

Which is Better for You?

Choosing between the Unified Pension Scheme and the NPS depends on various factors, including your service period, financial goals, and risk tolerance. This section will help you evaluate which scheme is better suited to your needs.

Future of Pension Schemes in India

The introduction of the Unified Pension Scheme signals a shift in the government’s approach to retirement planning. This section will explore the future of pension schemes in India and how the UPS fits into the broader landscape.

Challenges and Criticisms of the Unified Pension Scheme

Concerns Raised by Financial Experts

While the Unified Pension Scheme offers many benefits, it has also faced criticism from financial experts. This section will explore the concerns raised about the scheme, including its sustainability and impact on government finances.

Potential Risks of the Scheme

The Unified Pension Scheme is not without risks, particularly in terms of its long-term viability and the potential burden on taxpayers. This section will discuss these risks and how they may affect the scheme’s future.

Addressing the Criticisms

Despite the criticisms, the government has taken steps to address the concerns raised about the Unified Pension Scheme. This section will highlight the measures being implemented to ensure the scheme’s success and sustainability.

Future Prospects of the Unified Pension Scheme

Potential Amendments and Changes

The Unified Pension Scheme is a dynamic policy that may undergo amendments and changes over time. This section will explore the potential future developments and how they may impact current and future retirees.

Government’s Vision for the Scheme

The government has a clear vision for the Unified Pension Scheme, focusing on providing financial security and stability for retirees. This section will delve into the government’s long-term goals for the scheme and how they plan to achieve them.

Long-term Sustainability

The sustainability of the Unified Pension Scheme is a critical concern, particularly given the aging population and increasing life expectancy. This section will examine the steps being taken to ensure the scheme’s long-term viability.

Frequently Asked Questions about the Unified Pension Scheme

- What is the minimum service period required for full pension benefits?

- Answer: The minimum service period required for full pension benefits under the Unified Pension Scheme is 25 years.

- Can the pension be transferred to family members?

- Answer: Yes, the pension can be transferred to eligible family members in the form of a family pension upon the death of the pensioner.

- How is the pension amount calculated?

- Answer: The pension amount is calculated as 50% of the average basic pay drawn over the last 12 months before retirement.

- Is there an option to opt-out of the scheme?

- Answer: No, the Unified Pension Scheme is mandatory for eligible government employees, and there is no option to opt-out.

- How does the scheme compare to the Old Pension Scheme?

- Answer: The Unified Pension Scheme offers several advantages over the Old Pension Scheme, including a guaranteed minimum pension and family pension benefits.

- What happens if the employee retires early?

- Answer: Employees who retire early with at least 10 years of service are still eligible for pension benefits, although the amount may be reduced proportionally.