NPS Vatsalya Tax Benefits: When planning your financial future, particularly for your child, ensuring you take advantage of tax-saving options is key. The National Pension System (NPS) Vatsalya Scheme, launched in September 2024, offers parents and guardians a unique way to invest in their child’s future retirement while benefiting from the power of compound interest. Although the scheme is relatively new, its tax implications remain a point of curiosity for many. This article will explore the NPS Vatsalya Scheme, its potential tax benefits, and how it compares to other investment options in the Indian financial market.

What is NPS Vatsalya?

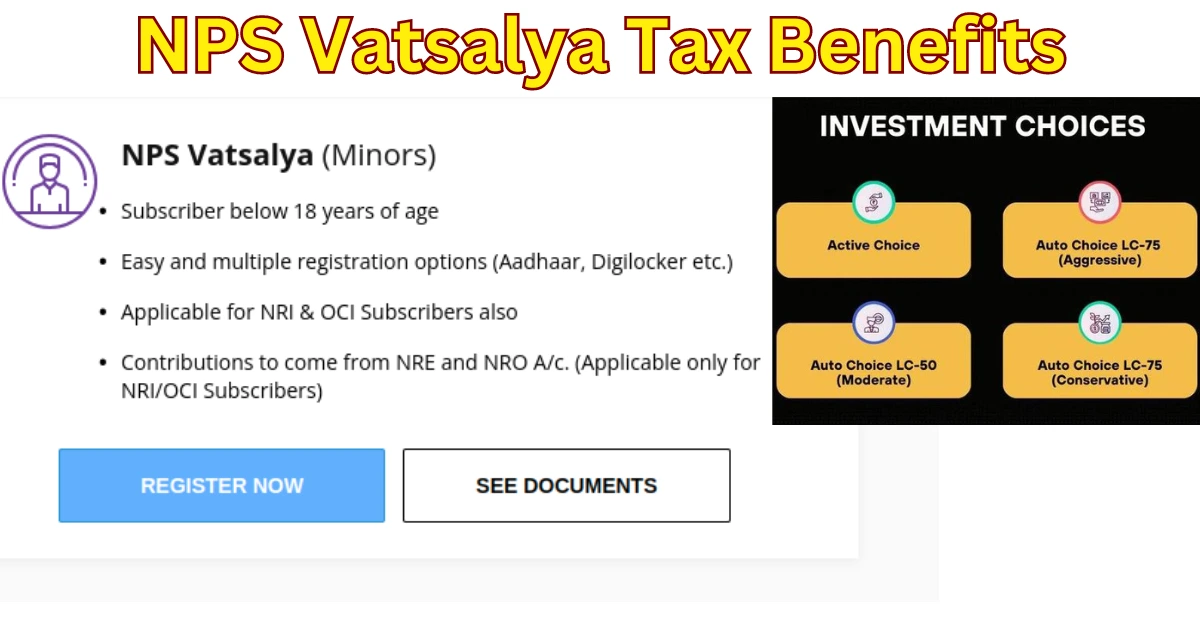

NPS Vatsalya is a pension scheme specifically designed to provide long-term financial security for minors. It allows parents or guardians to open an account on behalf of their children, which matures when the child turns 60. With flexible investment options and the opportunity to grow wealth over decades, this scheme offers a disciplined savings approach. Once the minor reaches adulthood, the account converts into a regular NPS account.

Read More: All About NPS Vatsalya: A Secure Future for Your Child’s Financial Well-Being

Key Features of NPS Vatsalya

- Equity Exposure: Up to 75% of contributions can be invested in equity, allowing for potentially higher returns.

- Lock-in Period: Funds remain locked until the minor reaches 60, ensuring long-term security.

- Flexible Contributions: You can start with as little as ₹1,000 per year, with no upper limit.

- Partial Withdrawals: Allowed for specific purposes, such as education and medical expenses, before the child turns 18.

These features make NPS Vatsalya a robust financial planning tool, but what about the tax benefits?

NPS Vatsalya Tax Benefits: Current Situation

As of September 2024, the Indian government has not yet announced explicit tax benefits for contributions to the NPS Vatsalya Scheme. This lack of clarity has left many potential investors wondering whether this scheme will offer the same tax-saving opportunities as the regular NPS account, which falls under Section 80C, 80CCD(1B), and 80CCD(2) of the Income Tax Act. However, given the precedent set by the NPS, it is reasonable to expect some form of tax relief in the near future.

Read More: NPS VATSALYA LAUNCHED: Your Child’s Financial Future Starts Today

Potential NPS Vatsalya Tax Benefits for Investors

Even though tax benefits specific to NPS Vatsalya have not been confirmed, it is useful to consider how similar schemes operate:

- Section 80C Deductions: Under the regular NPS, investors can claim deductions of up to ₹1.5 lakh per annum under Section 80C. It is possible that contributions to NPS Vatsalya may be eligible for this deduction once the government formalizes the tax framework.

- Section 80CCD(1B): An additional deduction of ₹50,000 is available under this section for NPS investments. If the same rule applies to NPS Vatsalya, investors could enjoy up to ₹2 lakh in tax savings annually.

- Tax-Free Maturity: Under the regular NPS, 60% of the corpus withdrawn at maturity is tax-free, while the remaining 40% must be used to purchase an annuity, which is taxable. NPS Vatsalya Tax Benefits may follow a similar tax structure for withdrawals, although this is yet to be confirmed.

How NPS Vatsalya Stacks Up Against Other Investment Options

When considering where to invest for your child’s future, it’s essential to compare NPS Vatsalya with other popular options like mutual funds (MFs) and Public Provident Fund (PPF).

- Mutual Funds: MFs offer greater flexibility and potentially higher returns, especially when saving for short-term goals like your child’s education. However, they lack the long-term security of NPS Vatsalya, and tax benefits are only available under Equity Linked Savings Scheme (ELSS) mutual funds.

- PPF: The Public Provident Fund offers assured returns and tax benefits under Section 80C but has a lower cap on contributions and interest rates compared to NPS. While PPF is excellent for conservative investors, NPS Vatsalya’s higher equity exposure gives it an edge for those willing to take on more risk for potentially higher returns.

In short, NPS Vatsalya may not be the best option for short-term financial goals like college savings, but it shines as a tool for long-term, disciplined investment in your child’s future financial independence.

Why Financial Experts Recommend NPS Vatsalya

Many financial planners recommend NPS Vatsalya for parents seeking to build a secure retirement fund for their children. According to S Joshi, a seasoned financial advisor based in Mumbai, “NPS Vatsalya promotes long-term savings, encouraging parents to take a disciplined approach toward financial planning for their child. Though the tax benefits are not fully disclosed yet, the potential for high returns and the lock-in feature make it a great option for risk-averse investors with long-term goals.”

Try This: NPS Vatsalya Calculator

Experts also highlight the importance of starting early to leverage the power of compounding. A minor enrolled in the scheme at birth could amass a substantial corpus by the time they turn 60, making NPS Vatsalya a powerful financial tool.

Is NPS Vatsalya Right for You?

NPS Vatsalya is an innovative financial product with long-term benefits for parents who want to provide financial security for their children. While the NPS Vatsalya Tax Benefits are not yet fully clarified, the scheme’s flexibility, long-term growth potential, and disciplined savings approach make it a strong contender for parents looking to invest in their child’s future retirement. It may not be the perfect choice for every family, but for those with long-term financial goals, NPS Vatsalya offers a safe, reliable, and potentially rewarding option.

Try This: SSY CALCULATOR

Respected Sir/ Madam,

While I was going through a video, it was mentioned that in case of demise of guardian, an insurance amount will be given to family.

Is it right? If yes,

What’s that insurance amount and its criteria to calculate insurance coverage

What kind of death would be covered i.e. normal/ accidental/ illness or something else. Will suicide be covered in it

Sincere Regards