Personal Finance

Explore expert insights and practical tips on personal finance in India. This category covers a wide range of popular investment schemes and plans, including Mutual Funds, Stocks, Fixed Deposits, Public Provident Fund (PPF), National Pension System (NPS), Sukanya Samriddhi Yojana (SSY), and more. Learn about budgeting, saving strategies, tax planning, and financial management to help you make informed decisions and achieve your financial goals.

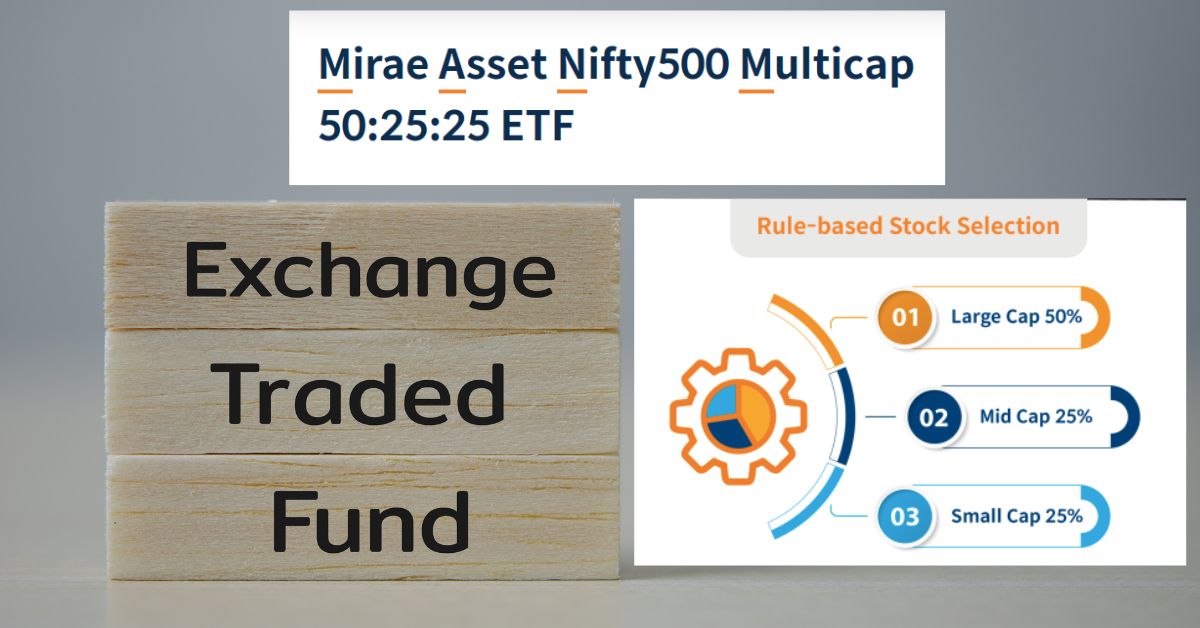

Mirae Asset Nifty500 Multicap 50:25:25 ETF: Minimum Investment, NFO Dates, and Who Should Invest

Mirae Asset Nifty500 Multicap 50:25:25 ETF has recently made waves in the investment community with its unique approach to diversification and balanced exposure. Launched as....

ITR Refund: Not Satisfied with a Lower Income Tax Refund Amount? Here’s What You Can Do

Income Tax Refund: Understanding Section 154(1) and Rectification Requests Filing your income tax return (ITR) is a significant financial task, and awaiting the refund can....

How to Get a Monthly Pension of Rs 1 Lakh NPS

For a comfortable, secure retirement and for without headaches, a monthly pension of Rs 1 lakh. Help is at hand! This easy, comprehensive guide will....

Budget 2024 Highlights for Common People, Taxpayers, and Child Savings

Budget 2024 Highlights: The Budget 2024 has brought several changes that will impact common people, taxpayers, and savings for children. The focus is on simplifying....

Senior Citizen Savings Scheme: Is it Right for You? Age, Eligibility, and Interest Rates Explained

Senior Citizen Savings Scheme (SCSS) is a government-backed investment plan designed for people aged 60 and above. Introduced in 2004, it provides a reliable and....