Indian financial market is a vibrant, ever-evolving landscape. For the past decade, we’ve seen explosive growth fueled by a booming startup ecosystem and significant infrastructure investments. However, as global uncertainties creep in, a sense of market volatility has returned, leaving many investors wondering, “What’s the best way to protect my wealth?” If you’ve been feeling this way, you’re not alone. It’s a natural reaction to a turbulent market. The answer isn’t to retreat entirely, but to adapt your strategy. The key to weathering these storms and achieving long-term success isn’t just about picking the right stock; it’s about building a robust, diversified portfolio.

The Problem with Putting All Your Eggs in One Basket

For a long time, many Indian investors leaned heavily on equities for growth and fixed deposits (FDs) for safety. The thought process was simple: stocks for potential high returns, and FDs for guaranteed, risk-free capital preservation. But as many a financial expert will tell you, this approach has its limits. An over-reliance on equities can expose your portfolio to significant risks during a downturn. And while FDs are safe, their returns often barely keep pace with inflation, meaning your purchasing power erodes over time. You might be saving money, but are you really creating wealth?

Try This: NPS Vatsalya Calculator

A well-known anecdote perfectly illustrates this point: I once spoke with a friend, a seasoned investor, who had seen his portfolio take a huge hit during a recent market dip. He had almost his entire savings tied up in a handful of high-growth tech stocks. “It was like watching my money disappear,” he told me, shaking his head. “I wish I’d spread it around more.” His experience is a stark reminder of why diversification isn’t just a buzzword—it’s a critical strategy for financial survival.

Diversification Is Your Safety Net and Your Engine for Growth

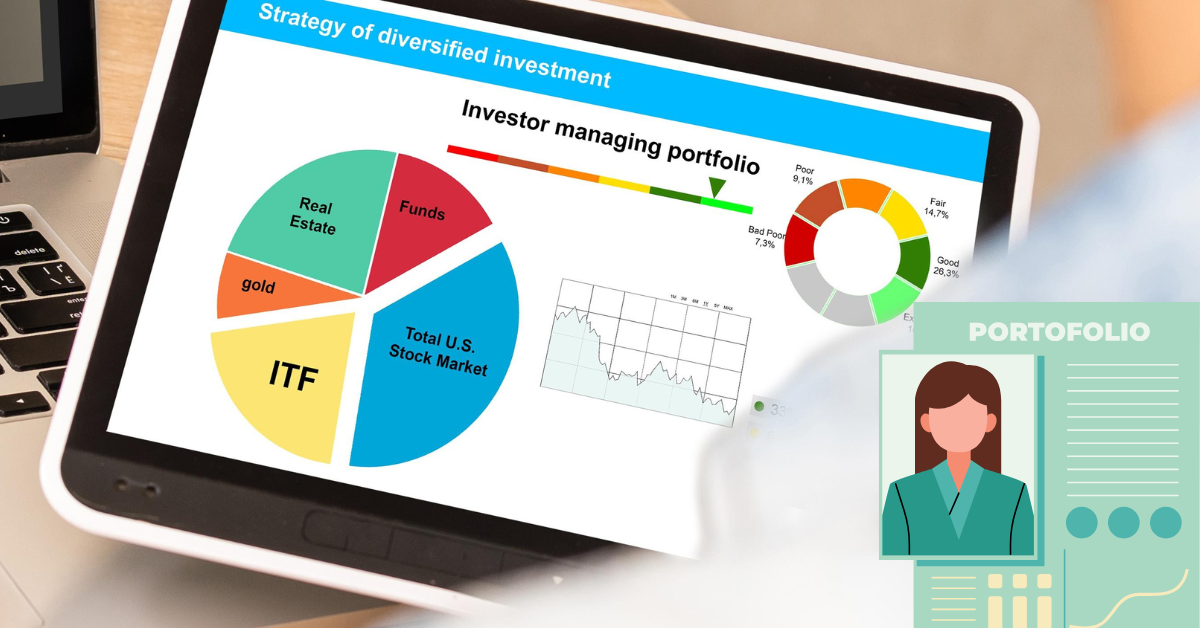

Diversification is the simple but powerful strategy of spreading your investments across different asset classes. Think of it as a financial safety net that helps you temper the growth that equities provide with the stability and predictability that fixed-income securities offer. By doing this, you’re not just protecting your wealth; you’re also creating a more resilient portfolio that can perform well in various market conditions.

The good news is that today’s digital platforms, like the one offered by Stock Holding Corporation of India, make it easier than ever to access a diverse range of investment instruments. You no longer have to rely on just FDs. You can now easily explore and invest in a whole new world of options that are more aligned with your financial goals.

Read More: Hidden Benefits of NPS: Your Guide to India’s Retirement Powerhouse

Exploring Your Diversification Toolkit

Let’s look at some of the key instruments you can use to build a stronger portfolio.

1. National Pension System (NPS): A Cornerstone for Retirement

The National Pension System (NPS) is a government-backed retirement solution that allows you to systematically build a retirement corpus. It’s a fantastic tool for diversification because it gives you exposure to different asset classes—equities, corporate bonds, and government securities—all within a single scheme. You can customize your asset allocation based on your risk appetite. For instance, during volatile times, you can increase your fixed-income exposure for greater stability. NPS is also tax-efficient, offering tax savings up to ₹1.5 lakhs under Section 80CCD on your Tier 1 account contributions.

2. Floating Rate Savings Bonds (FRSBs): The Inflation Hedge

The Reserve Bank of India’s Floating Rate Savings Bonds (FRSBs) are another excellent option, especially for those worried about inflation. What makes these bonds unique is that their interest rates adjust periodically based on prevailing market rates, providing a natural hedge against rising interest rates and inflation. With no investment cap and a seven-year tenure, they offer a dual benefit: capital preservation with the potential for increasing returns when interest rates rise.

3. Mutual Funds: Professional Expertise at Your Fingertips

Mutual funds offer a straightforward path to diversification, combining professional expertise with accessibility. By pooling money from multiple investors, these funds create a diversified portfolio managed by financial experts. You can choose funds with customized risk profiles. For example, conservative hybrid funds with higher debt allocations can provide stability when equity markets fluctuate, while still offering better potential returns than pure fixed-income options. The Systematic Investment Plan (SIP) approach lets you invest small amounts regularly, taking advantage of market dips through rupee-cost averaging.

The New Investment Mandate: Balance, Not Blind Growth

The Indian market regulator, SEBI, has also recognized the need to popularize debt assets, a clear sign that they see it as a critical component of any portfolio. They’ve even reduced the minimum investment threshold in privately placed bonds to ₹10,000 to make them more accessible to retail investors. This move further underscores the importance of a balanced portfolio.

Read More: NPS vs OPS Which Is Better for Retirement in India 2025

Ultimately, your investment journey is no longer just about chasing explosive equity growth. It’s about a strategic, balanced mix of financial instruments designed for long-term success. By embracing diversification and utilizing a range of tools—from NPS and FRSBs to mutual funds and corporate bonds—you’re not just reacting to market conditions. You’re building a resilient portfolio that can navigate the ups and downs, ensuring your financial future remains secure, no matter what the market throws at you.