The year 2025 closes with a whisper rather than a bang for many equity enthusiasts. If you look back at your portfolio performance, a sense of lukewarm satisfaction might prevail. Large-cap indices remained stubbornly range-bound. Mid-caps struggled to maintain momentum. Small-caps, the darlings of the previous biennial cycle, delivered a sharp correction. This environment functioned as a harsh proving ground for asset allocation.

Wealth experts observed a clear pattern. Investors who tethered their entire fortune to equity experienced significant volatility with minimal reward. Those who maintained a balanced exposure across debt, gold, and international assets secured their capital. 2025 validated the shouts of every advisor who championed diversification. It proved that risk management remains your primary defense against a stagnant index.

Courage as a Mathematical Edge

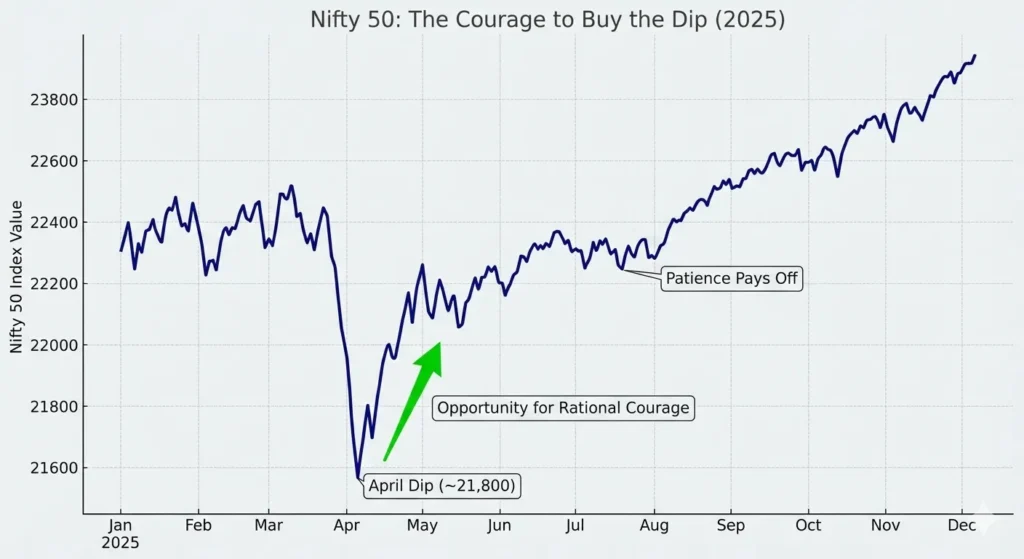

Market dips in 2025 felt like tremors. Many retail participants retreated when the Nifty 50 drifted toward 22,000 during the spring. Panic dominated the narrative. Sophisticated wealth managers, however, viewed these moments through a lens of rational courage.

Consider a specific instance from April. Nifty plummeted to 21,800. Sentiment turned frosty. One high-net-worth investor faced a choice: pause his contributions or double down. By advancing his bonuses into the market during that 15% correction, his portfolio internal rate of return (IRR) surged far beyond the headline index.

History suggests that markets fall roughly 15% in most calendar years. Your ability to view these drawdowns as opportunities determines your long-term wealth trajectory. Courage is not an emotion; it is a calculated response to temporary price dislocations.

Read More: EPFO 3.0 Features and Launch: What You Need to Know in 2025

The Alpha Struggle: Active vs. Passive

The data from 2025 creates a dilemma for those seeking to beat the market. Passive funds frequently outperformed active managers. As the total Assets Under Management (AUM) in India swelled, finding “alpha” became increasingly difficult. Only a handful of active large-cap funds managed to surpass the benchmark.

Experts attribute this to massive Foreign Institutional Investor (FII) outflows. When global capital exits, large-cap stocks face immense selling pressure. Domestic funds struggled to compensate for a ₹1.5 lakh crore vacuum. This year taught us that active management requires extreme selectivity. You cannot simply pick any fund and expect outperformance. For 2026, a hybrid approach involving low-cost index funds and high-conviction active mid-cap funds appears most prudent.

Try This: NPS Vatsalya Calculator

Gold: The Systemic Signal

Gold and silver redefined their roles in your portfolio this year. This was not a mere speculative rally. It represented a systemic reaction to global debt concerns. As the US monetary supply expanded, precious metals became a sanctuary for cautious capital.

Silver experienced heightened industrial demand, yet gold remained the psychological anchor. Financial analysts suggest that gold acts as a hedge during 66% of the months when the Nifty 50 is negative. If your portfolio lacked this “revolt asset,” you felt the opportunity cost. Moving forward, a 10% to 20% allocation to gold serves as more than a safety net; it provides a non-correlated growth engine when equities falter.

Read More: GST Reforms: A Financial Game-Changer for India

Strategic Blueprints for 2026

Entering 2026 requires a shift in your mental framework. The easy gains of the post-pandemic era have vanished. Success now depends on nuanced execution.

- Re-enter Small-caps with Caution: After the negative 7% returns of 2025, valuations in the small-cap space look more attractive. Avoid chasing past winners. Focus on funds with low churn and high active share.

- Staggered Accumulation: Do not deploy lumpsum cash into gold at lifetime highs. Use a systematic approach to build your hedge over the first two quarters of 2026.

- Fixed Income Realism: With interest rates remaining sticky, debt funds offer a stable 7% to 8% return. Use these as a parking ground for liquidity, ready to pounce on equity volatility.

- Trust Domestic Inflows: The Indian retail investor is the new market stabilizer. This domestic wall of money provides a floor for prices, reducing the impact of global FII tantrums.

Your journey through 2025 likely tested your patience. The market demanded discipline and punished greed. As you prepare for 2026, remember that wealth is built during the boring years, not just the booming ones.

Read More: Sukanya Samriddhi or NPS Vatsalya: Why ₹69 Lakh Isn’t Enough & Better Investment Options